Over the years, the business landscape has changed immensely. Organizations no longer depend on guesswork, and numbers drive decisions. Therefore, they need accurate, real-time pieces of information at all times. The concept of data brokerage has gathered popularity because companies cannot rely only on their own sources to collect information. As a business owner, you can well imagine the challenge of information mining, but brokers can make things a lot easier. They collect, process, clean, and structure the numbers and provide them to the firms in usable forms.

Here are some 4 good reasons to collaborate with a data broker sooner rather than later.

1. Help with Market Analysis

Marketing is perhaps the trickiest business operation, specifically when launching a new product or service. You need to conduct an in-depth market analysis to understand concepts like consumer expectations, demand, and competition. Experts at US Marketing Management suggest that you must have a considerable volume of data for valuable analysis. It ensures actionable insights that drive better decisions. You will have to dig deep for information, even more, if you want to target global markets. The best way to access it is with the help of a data broker because they can provide you with information from far and wide with minimal effort.

2. Enable Targeted Advertising

Another benefit you can avail of with the collaboration comes in the form of targeted advertising. It enables you to send relevant ads and email offers to potential buyers based on their online activity. Gathering information about audience activity can be a humongous task for any organization. But a data provider has it for you on the fly. You get to connect with the audience more meaningfully, offering them what they need and want. The best part is that you can do it without wasting time and effort because the broker handles that part of the job.

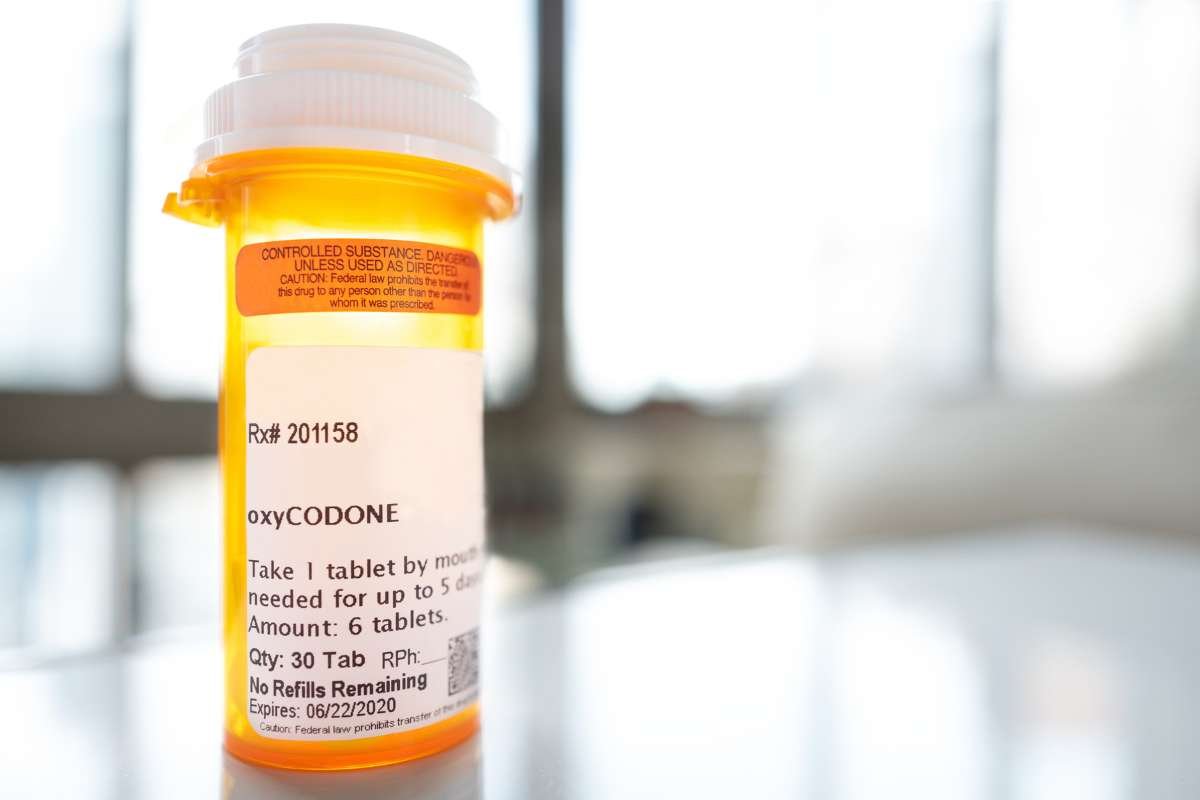

3. Provide Data for Investment Models

The role of data brokers extends beyond retail companies and service providers. Even the fintech sector can derive immense value from them. Traditionally, investors use limited data sources and types for investment decisions. Even large fintech companies struggle to get the necessary information for investment models. It makes sense to collaborate with a data broker for valuable facts and figures that help with investment models. They ensure the accuracy and timeliness of information so that firms and investors can make the best decisions for optimal and risk-free growth.

4. Better Profiling of Leads and Job Candidates

Hiring is also data-driven today as most companies rely on algorithms to screen potential candidates. HR managers expect to see extensive candidate profiles before the interview. The same goes for lead profiling, where sales teams expect to analyze, score, and rank sales leads to approach them correctly. B2B companies can rely on data brokers to get relevant data on candidates and leads to ramp up both operations and reduce the workloads of HR managers and sales representatives.

Undoubtedly, data brokers can make businesses run better while saving time and energy on gathering and crunching numbers. They can serve a combination of volume, variety, and veracity, which isn’t something any business can manage on its own.