Did you know that 80% of Americans are in debt? Taking a loan is a big financial decision that shouldn’t be taken lightly. Additional debt has the potential to boost your financial health, but it could also do some severe damage if irresponsibly handled. This article will take you through the best and worst reasons you could have for taking out a loan.

Factors to Consider Before Taking a Loan

- A loan is a financial commitment that requires discipline and hard work to recover from. The first thing you should ask yourself before taking a loan is, “Do I have another option?” Consider all the credit options at your disposal.

- The next thing you need to think about is your current and future financial situation. This will help you calculate how much you can pay. Most lenders will confiscate your personal property should you fail to pay up. If you do not want to go through the horrible loss of personal assets to debt collectors and auctioneers, this step is crucial.

- Next, you need to consider whether you will put your loan into a money-generating activity. Sometimes we happen to identify high-potential investment opportunities that could rake in enough money to pay off a loan and then some. In this case, taking a loan is a wise move as it could potentially bring in some income. The only difference, in this case, would be the loan is a business loan and not a personal loan.

Good Reasons to Take a Loan

When taking out a loan, exercising sound judgment could save you years of financial struggles and inevitable financial ruin. If you are trying to figure out whether to take a loan or not, here are a few good reasons to take a loan.

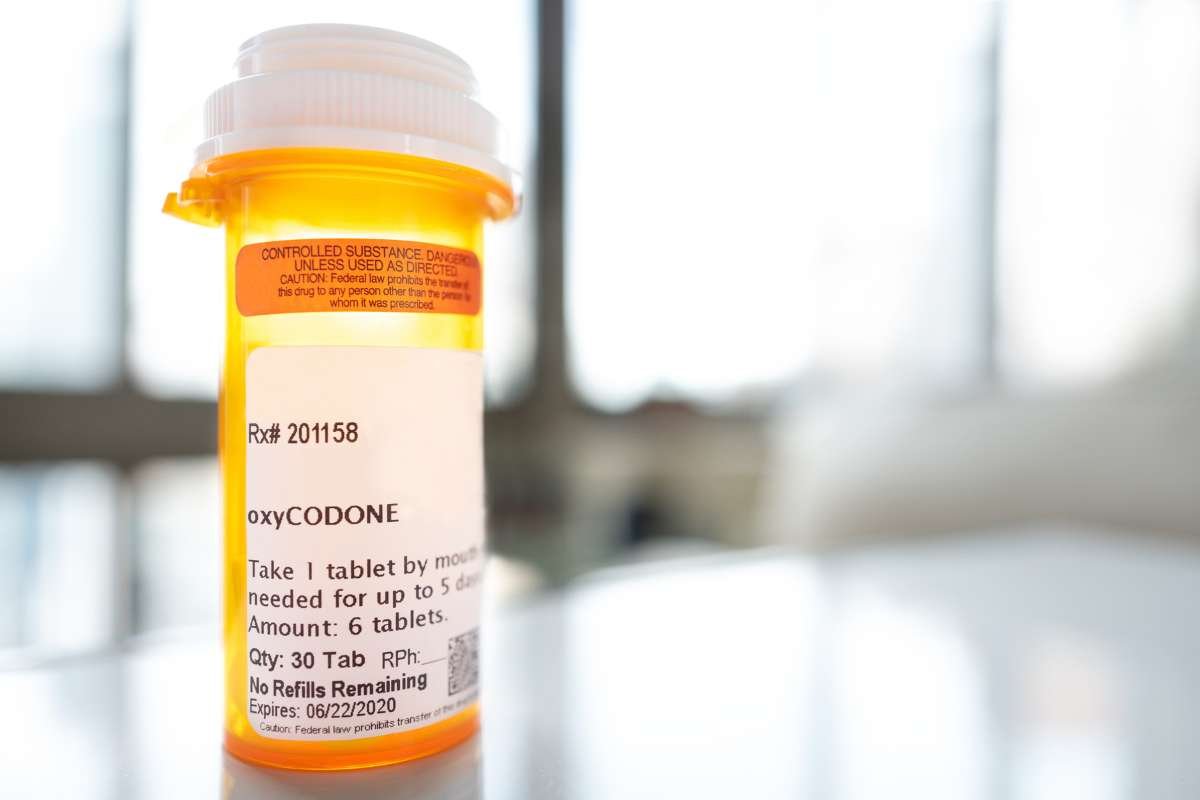

1. Paying Off High-Interest Debt

Taking out low-interest debt to pay off high-interest debt is one of peoples’ good reasons for taking a loan. The process is called refinancing and can come in handy if you want to pay less interest rate. It makes more sense to pay off a loan at lower interest rates because you will finish paying it faster and eventually pay less.

2. Debt Consolidation

If you have more than one outstanding debt, this process will definitely make sense. It can be hard to keep track of all your debts and make payments on time. It is even harder to keep up with the terms and conditions associated with each loan. There is no need to go through the trouble of managing multiple loans when you can pay them all off and pay just one loan. Focusing on one loan is also beneficial because you will feel less overwhelmed by the business loans.

The Worst Reasons for Getting a Loan

These are some of the worst reasons you can take out a loan.

3. Purchasing Unnecessary and Unaffordable Purchases

Unnecessary or temporary pleasures make for the worst spending habits. Only take out a loan to purchase long-lasting and meaningful items.

4. Financing a Lifestyle You Can’t Afford

Living beyond your means can lead to unnecessary spending, inevitably accumulating debt. Some people feel pressured to live according to a certain standard set by society or friends and colleagues. Our advice would be to live below your means for now so you can enjoy a better life tomorrow.

5. Accumulating Pointless Debt

Some people find themselves taking a loan for no reason other than they can. You might not realize it, but debt can be very addicting. It is entirely possible to take out a loan, pay it up and take another one right away; many people live like this.

When you think about it from the lender’s point of view, you are helping them make a decent living from your poor financial mistakes. Don’t fall victim to the credit feedback loop from hell as we like to call it. Only take out loans that are an absolute necessity.