Nike’s Shares React to Mixed Results

Nike delivered better-than-expected financial results on Thursday, with shares initially surging by 11%. However, optimism was short-lived as CEO Elliott Hill and CFO Matthew Friend tempered expectations, predicting a significant revenue drop in the third quarter. This led to shares reversing course and closing lower. In his first earnings call since becoming CEO in October, Hill acknowledged that Nike had “lost its obsession with sport” and vowed to bring the iconic brand back on track. Hill emphasized that Nike’s future lies in premium pricing, innovation, and a renewed focus on sports performance.

Despite overall revenue falling 7.7% to $12.35 billion—better than the anticipated 9.41% decline—Nike’s profits exceeded modest estimates. The company reported earnings per share of 78 cents, surpassing analyst expectations of 63 cents. Hill highlighted that newer models of performance and running shoes have already started attracting shoppers, offering a glimmer of hope for Nike’s turnaround.

Strategic Shift to Address Challenges

CEO Elliott Hill outlined key priorities to drive Nike’s recovery, including rebuilding retail partnerships, enhancing innovation, and limiting aggressive discounting practices. “We’ve become far too promotional,” Hill remarked passionately, pointing to frequent markdowns as damaging both Nike’s brand value and retail partners’ profitability. Going forward, Nike plans to restrict discounts to traditional retail periods instead of offering them consistently.

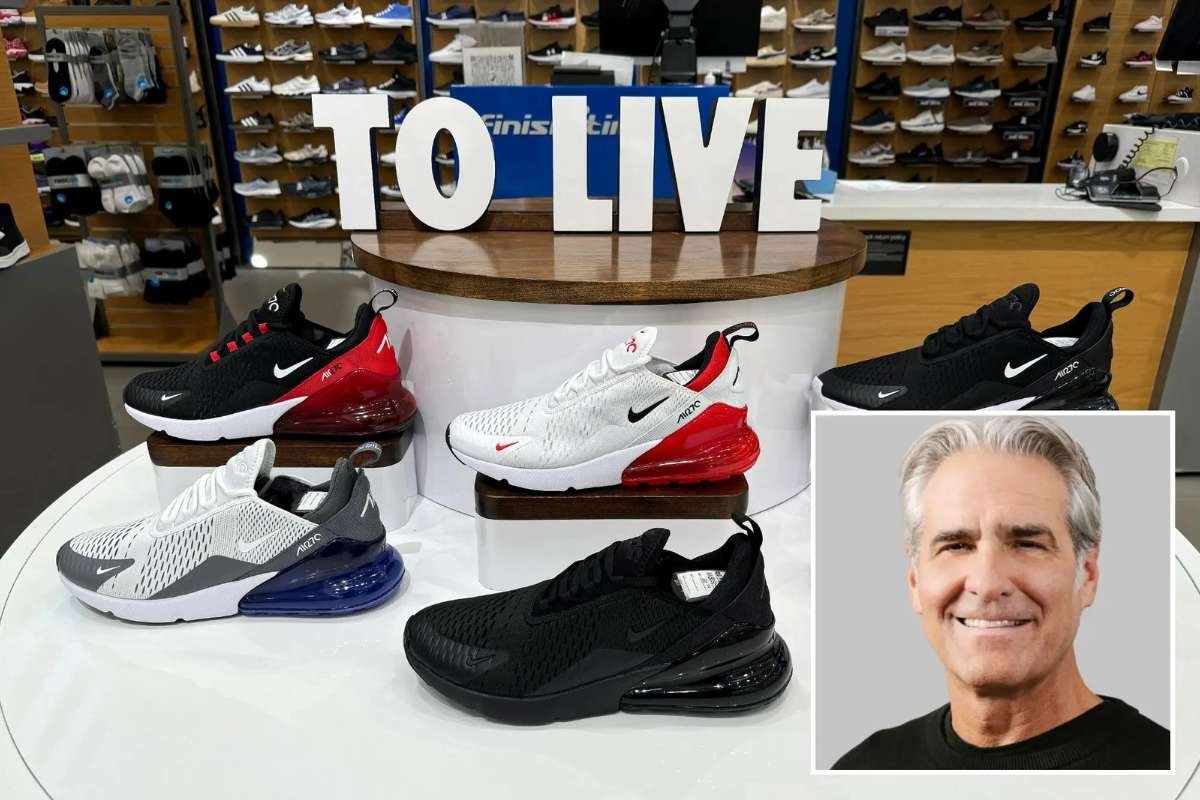

The company has faced growing competition in the footwear market, with rivals like On and Hoka introducing popular, more comfortable designs. In response, Nike is investing heavily in refreshing its classic franchises such as Air Max, Jordans, and Pegasus. Under Hill’s leadership, Nike also announced plans to double down on its core running franchises—Pegasus, Structure, and Vomero—by launching multiple iterations at varying price points next year.

Rebuilding Partnerships and Market Confidence

Retailers have expressed optimism about Hill’s leadership, particularly regarding Nike’s renewed commitment to third-party partnerships. Nike had pivoted heavily toward direct-to-consumer sales in 2020, leaving some retailers scrambling to fill shelves with competitor products. While brands like On and Hoka benefitted, retailers like Foot Locker, which sourced 65% of its sports apparel from Nike, struggled to maintain sales.

Foot Locker, in particular, blamed weak demand for Nike products for its disappointing performance earlier this month. However, executives at the retailer voiced hope for improved collaboration under Hill’s leadership. Nike’s renewed strategy to balance direct-to-consumer and wholesale partnerships could signal a turning point for the brand’s relationship with retail partners.

Jessica Ramirez, senior analyst at Jane Hali & Associates, noted that while Nike’s numbers remain underwhelming, the results were better than expected. “If you really look at it, the numbers are not good,” Ramirez said. “But it’s better than most people feared.”

As Nike moves forward, CEO Elliott Hill’s plans to revive the company’s identity around sports, innovation, and premium pricing will be closely watched. The CEO’s strategy, though likely to cause short-term challenges, aims to rebuild Nike’s reputation and position the company for long-term growth.