Nonprofit Junior Achievement USA and tax, accounting, and consulting company RSM conducted a poll on the perceptions of young people about investing after GameStop’s stock market frenzy.

Almost 40% of adolescents perceive the stock market as a way to “earn money fast,” while just 20% say it’s “too hazardous,” after GameStop’s climbs and falls. 40 percent of those surveyed said they still believe equities are a decent long-term investment, according to the poll.

Responses reveal that just half of the adolescents think the stock market is a beneficial thing for the average American. According to the report, 37 percent of adolescents would not invest in the stock market if given the opportunity. According to Ed Grocholski, Junior Achievement USA’s senior vice president of brand, some youths have been “essentially shelved” due to the issue.

According to wealth adviser Leona Edwards, a certified financial planner with Mariner Wealth Advisors in Nashville, “It’s reasonable why people would be cautious to put money into the stock market.” “However, it might have a significant impact on their ability to save for the future.”

Grocholski added that their hesitation to participate might harm their initial 401(k) contributions.

When it comes to saving for the future, “we all know that you need to get started early,” he remarked. “That’s not going to be the case for a substantial number of kids,” says Dr. Smith.

Teens’ skepticism about the stock market was evident in a poll, but they also expressed curiosity.

Most teenagers, if given the option, would put their money in the stock market, 25 percent in cryptocurrencies, and 24 percent in real estate, according to a survey. Furthermore, as time passes, the Forex market, the world’s biggest financial market, grows in popularity among young people. The bonus scheme given by FX brokers is one of the key reasons why the Forex market is popular among teens. Many young people currently look for bonuses on websites such as www.ForexBonuses.org, where there are promotions and incentives for both newbies and experienced FX traders. Such promos are usually one of the most typical techniques for FX brokers to acquire more and more consumers.

In addition, the poll found that 43% of teenagers get their stock and Forex market information from social media. Some 35 percent of young investors consulted their parents, websites, and schools for advice.

Does Teen Stock Market Trading Seem Dangerous?

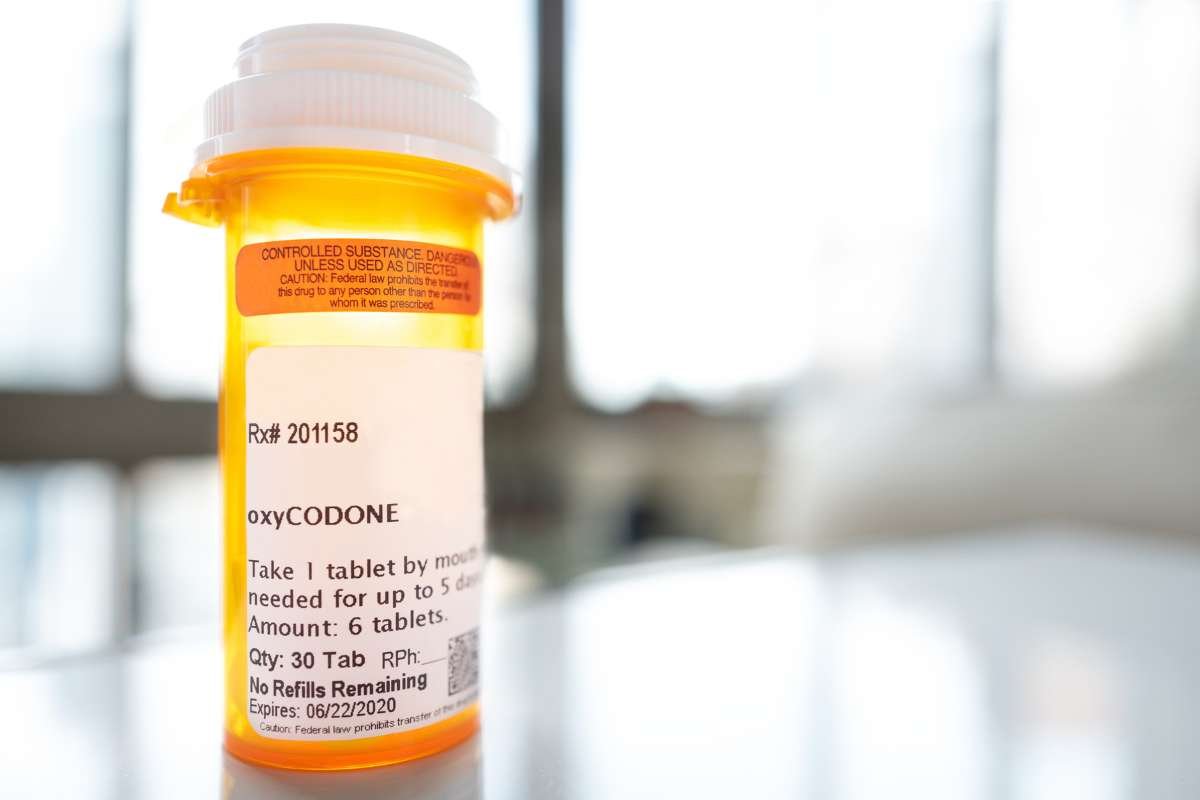

In order to open a brokerage account and trade without supervision, you must be at least 18 years old.There are also certain brokerage fees attached. Even though it may have reduced taxes on any profits, college financial assistance examiners will take into account the whole sum.

As part of your research, find out whether you may acquire fractional shares of high-priced companies, such as Apple. Ask about trading commissions, account fees, and any minimum balance requirements before making a decision. As part of your research, find out whether you may acquire fractional shares of high-priced companies, such as Apple.

If you are a novice investor, Christine Benz of Morningstar’s personal finance department has major misgivings about purchasing individual stocks. Teenagers, on the other hand, gain a greater understanding of wider economic factors when they buy and sell specific equities. When it comes to individual stock losses, they might teach you a vital lesson early on.

The positive of stock ownership for teenagers is one of the drawbacks. It is possible to feel like an invincible warrior after making large advances. It’s a significant threat right now, considering the recent success of several technology equities.

Mr. Clements has come up with a new idea. Set a ceiling for any stock’s increases. Invest in a simple index fund after you’ve made enough money to cover your losses.

Even if a young investor’s single-stock gunslinging results in a windfall, their exposure to mutual funds is still valuable. Although corporate retirement plans rely on these funds, they’re the greatest way for most individuals to secure their financial future. Having a little amount of stock in your company will give you an idea of what to do when you join the workforce.

The hope is that this will be the spark that ignites their interest in investment and converts them into lifelong investors, as Mr. Clements put it. It’s a great benefit if you can achieve that.”

Night Trading And Youngsters

People used to day trade back in the day, didn’t they? The practice of online trading stocks, options, and other financial instruments throughout the day has begun to seem like a bygone era. One of them has been sleeping on a cot next to his computer in case the stock market shifts in response to the events in Japan and Libya.

Or at the very least, day trading is out of date. To be on-trend, traders should engage in late-night and early-morning trades.

In 1999, the SEC granted investors the ability to trade equities before and after regular trading hours. As a result of this, Brooks McFeely, a navy officer, and occasionally independent trader, launched a news service to profit on the rush of individuals who wanted to trade outside of the usual trading period, to pounce on news like earnings announcements.

A tech bubble popped, resulting in less enthusiasm. A few years ago, trading began up again, but it has taken the recent global turbulence to awaken the night owls.