(source-cnbc.com_.jp)

On Thursday, CNBC’s Jim Cramer expressed his hope that Wall Street will temper its larger-than-life perception of Nvidia now that the company’s much-anticipated earnings report has been released. Cramer suggested that investors might now shift their focus to other valuable stocks that have been “lost in the Nvidia shuffle.”

“After this quarter, I’m hoping Nvidia becomes just another company, maybe even a boring one,” Cramer said. “One that’s valued based on earnings rather than hype and used AI-powered stocks”

Investors Encouraged to Diversify Attention Beyond Nvidia’s Hype

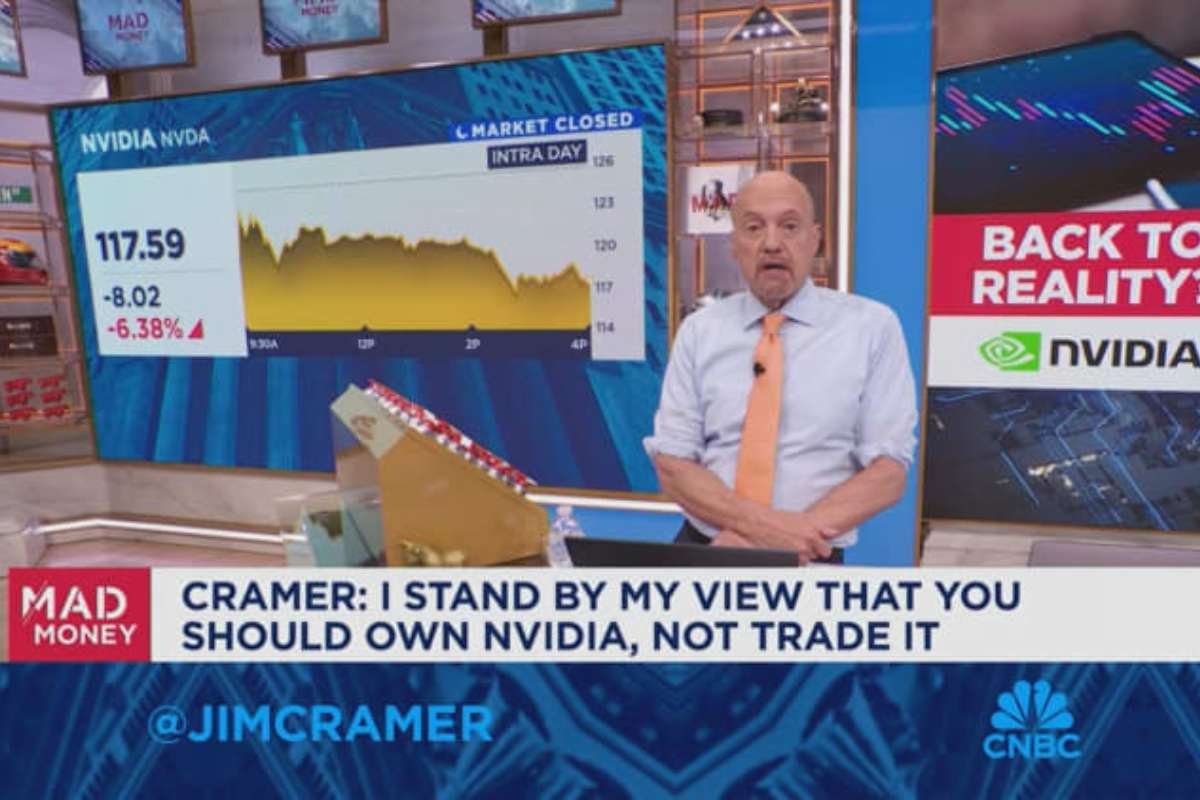

Despite Nvidia beating estimates and offering stronger-than-expected guidance in its Wednesday report, the stock still fell over 6% on Thursday. Cramer noted that Wall Street had grown accustomed to Nvidia consistently exceeding expectations, which had set a very high bar for this quarter. While the decline didn’t erase Nvidia’s impressive gains this year—up more than 137% year-to-date—it highlighted the unsustainable expectations surrounding the stock.

Cramer reiterated his belief that investors should own, not trade, Nvidia, but he emphasized that many had come to view the stock unrealistically. He reminded viewers that Nvidia is not a “miracle maker” or a “cult” but a company that enables valuable technology. He also expressed hope that those who had speculated on Nvidia rather than investing in it for the long term would move on.

Cramer Highlights AI-Powered Stocks Like AMD, Apple, and Salesforce

Cramer pointed to other stocks deserving of investor attention, including AMD, Apple, Amazon, and Salesforce. He noted that these companies effectively use generative artificial intelligence, with AMD’s chips in the same category as Nvidia’s. He highlighted Apple’s upcoming AI-enabled iPhone, Amazon’s successful use of AI to analyze buying patterns and expedite deliveries, and Salesforce’s AI tools that enable cost-saving automation for enterprise customers.

“As much as I love Nvidia, I’m thrilled that we can finally return to a market where there are many important stocks representing many important trends, instead of one stock that’s captured the attention of legions of investors, many of whom have no idea what it does or where it fits into the technological landscape,” Cramer said.

Also Read : The Enterprise world