One of the metrics that can help assess the performance of any business is the efficiency of its processes and workflow. Finances and accounting, for instance, is a department that holds technical functions that offers support to the entire organization. With it being an essential component ensuring the smooth running of the company, it’d be ideal to seek the services of financial planning experts to handle this aspect better.

If you’re looking to streamline your financial processes and boost efficiency, you might consider to hire a virtual assistant to assist with financial planning. Outsourcing financial planning can not only save you time but also provide access to specialized expertise, reduce costs, and improve overall financial management. It’s a strategic move that can help your business thrive in today’s competitive landscape.

This article aims to outline some of the benefits of outsourcing financial planning services for your business.

1. Quality Financial Services

An outsourced financial planning provider has the requisite skills to handle your business’s financial planning aspects and needs. Aside from the initial qualifications, they also have gained substantial experience from serving various clients over the years. This puts them in a better position of providing quality financial services to your organization than an in-house team.

Their quality is even more guaranteed if they have experience meeting customers’ needs in the industry your business serves. This enables them to understand your business needs better and satisfy them.

2. Cost-Effective

With an in-house finance team, you must have a budget for their monthly compensation and benefits, as well as a budget for training new employees. All these require much use of your financial resources, even time. You’d also need to purchase equipment to help them execute their responsibilities properly. This adds to your operational costs.

However, when outsourcing your finance functions, these costs can be eliminated. The financial planner already has a qualified team and the required technology and equipment to accomplish the tasks at hand. More so, most providers offer virtual CFO services. Therefore, you wouldn’t need to worry about getting an office space for them.

On the other hand, you can still opt for an internal team to ensure transparency, considering you’re getting the services of a third-party provider.

3. Better Business Cashflow

An outsourced financial planner will lay down strategies that you can use for better financial planning. They’ll look at your income levels against your expenditure to better understand your cashflows. If you have a negative cash flow, they can devise an easy-to-execute plan to help you make a turnaround. These strategies can provide your business with better cash flow since they also factor in your financial goals and budget.

This way, you’ll not overspend on any given operation or go out of your planned budget. If a new need arises, they’ll be no unplanned reallocating of funds; the provider will articulately plan for them. With such a plan in place, there’ll always be finances to cater to your needs without debts.

4. Increased Goal Achievement

Any business operates intending to achieve specific goals besides making profits. A managed financial planner can help make this possible and more effortless.

First, they will inquire about your goals, both short and long-term, noting down the amount of money needed to realize each as well. More often than not, the financial figure scares business owners from attaining their goals. With that said, your planner can help you break down this figure into small achievable amounts. They’ll go from a five-year plan to a monthly figure, which is often more feasible. More so, a monthly figure is also more realistic to your team, motivating them to work harder and smarter to attain them.

5. Reduced Risks

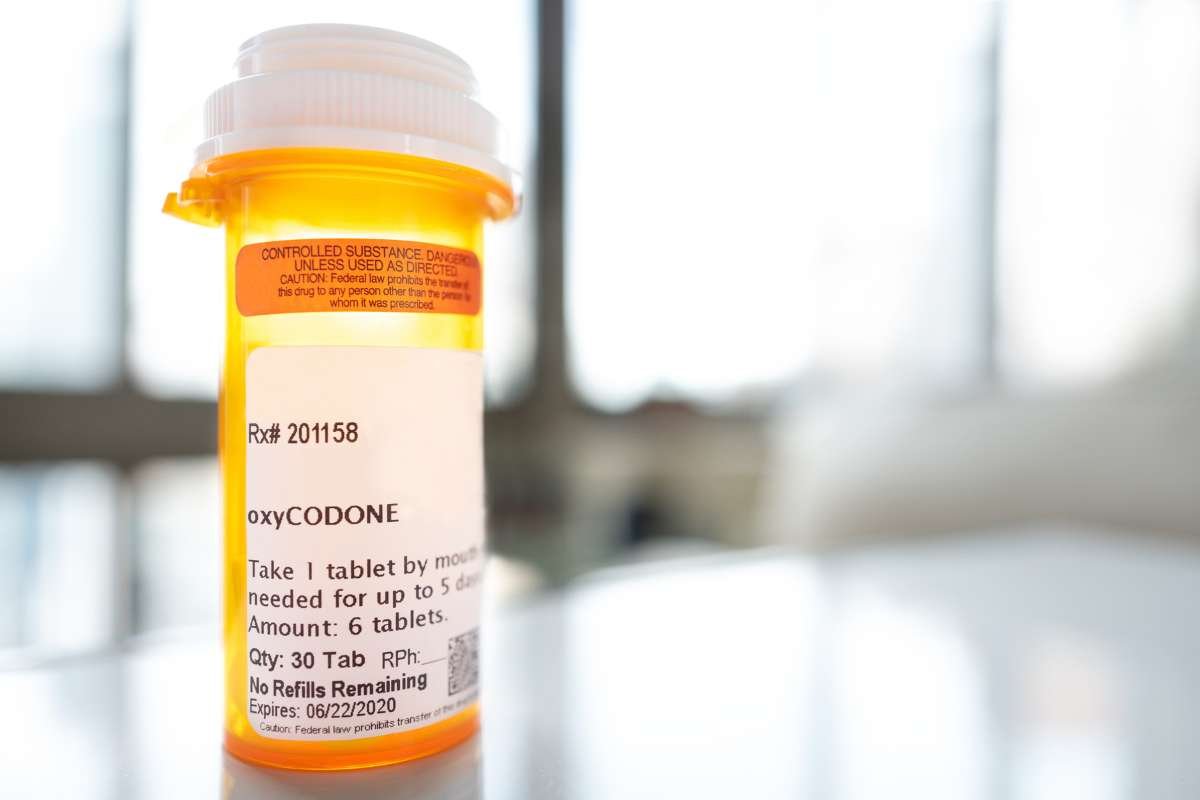

Part of the services of a managed financial provider is acquiring the funds needed for your business. One of the ways is to make investments. However, this can be a risky endeavor for any company or individual. It would be helpful if you’re knowledgeable about what to invest in and look out for, including identifying investment scams.

An outsourced provider has gained experience over the years and knows the best strategies and methods for investments to get particular yields. This know-how includes how to vet investment opportunities and assess their viability. With viable and wise investments being made, the risk of losing your business money through bad investments can be reduced to the bare minimum.

More so, a managed financial expert can help reduce the risk of your business being subject to fines and penalties, including closure, due to non-compliance. As they manage your business finances, they can put into account the taxes or payables you need to settle. This can ensure that they’re catered for, and your business won’t fall back on any payment or statutory regulations.

Conclusion

These days, you can access all sorts of professionals for outsourcing, from a US based virtual assistant to project managers, marketing experts, and financial planning professionals. When it comes to the latter, businesses can benefit hugely by outsourcing to the right agency or professional.

The financial aspect of any business is a critical core component. While an in-house team can perform accounting and financial planning functions, opting for outsourcing this service click here can significantly be to your business’s advantage.

With the benefits mentioned above, you can make an informed decision whether or not getting the services of a managed financial provider is the right call for your company.