Many people struggle to secure loans because traditional credit scores don’t always reflect their true financial situation. Outdated assessment methods leave millions underserved while lenders miss opportunities and face higher default risks. AI-powered credit risk solutions are changing this landscape by leveraging real-time financial data to provide a clearer, fairer evaluation of borrowers. These advanced tools help financial institutions reduce credit risk, approve more loans, and comply with evolving regulations—all while making credit more accessible. By enabling faster, smarter decisions, improving fraud detection, and balancing risk with opportunity, companies in this space are transforming lending.

Carrington Labs is at the forefront of this shift, redefining credit risk assessment with AI-powered solutions. Founded in 2024 after emerging from Beforepay Group, the company goes beyond traditional scores, analyzing real-time financial behaviors like income stability and spending patterns to ensure fairer lending decisions. Serving banks, credit unions, fintechs, and alternative lenders, its AI models integrate seamlessly into existing systems. CEO Jamie Twiss emphasizes the company’s commitment to innovation, transparency, and fairness. Processing over 40,000 loan applications weekly, Carrington Labs has improved credit risk accuracy by 30% while analyzing over a billion data points. Looking ahead, Carrington Labs aims to enhance its AI, enter new markets, and lead the transformation toward real-time, data-driven lending.

The Birth of Carrington Labs

Carrington Labs began its journey in 2024 with a mission to transform how lenders assess credit risk and make credit decisions. Initially developed within Beforepay Group—a fintech company that went public just 2.5 years after its launch—the company identified a broader opportunity for its AI-powered credit assessment models. These models, originally designed to improve lending decisions at Beforepay, demonstrated significant accuracy in evaluating borrower risk. Recognizing their potential, Carrington Labs expanded its focus to serve banks, fintechs, and lenders worldwide.

Traditional credit scores often present an incomplete picture of a borrower’s financial health, limiting fair access to credit. Carrington Labs addresses this challenge by leveraging explainable AI and alternative data sources, such as income patterns and spending habits, to provide lenders with a clearer and more reliable measure of creditworthiness.

Since its inception, the company has forged global partnerships with financial institutions, helping them refine their credit risk assessment strategies, enhance lending processes, and promote financial inclusion. By combining cutting-edge technology with a commitment to responsible lending, Carrington Labs continues to drive innovation in the credit risk space.

Overcoming Credit Score Limitations

Lenders today face major challenges in credit risk management—outdated scoring models, complex regulations, and the need for faster, more accurate decisions. Many borrowers are overlooked because traditional scores fail to capture their full financial picture. Meanwhile, compliance remains time-consuming, and speeding up approvals without compromising accuracy is a struggle.

Carrington Labs solves these issues with AI-powered credit risk assessment, offering a holistic view of borrower finances. By analyzing income stability and spending patterns, its explainable AI enhances transparency and improves credit risk accuracy. Leveraging alternative data, such as real-time income trends, lenders gain deeper insights to reduce defaults and approve loans with confidence.

Unlike static credit scores, Carrington Labs’ AI integrates traditional and transaction data through open banking, delivering tailored risk profiling. Its AI framework processes vast datasets, detecting key risk indicators and streamlining decision-making with minimal manual effort.

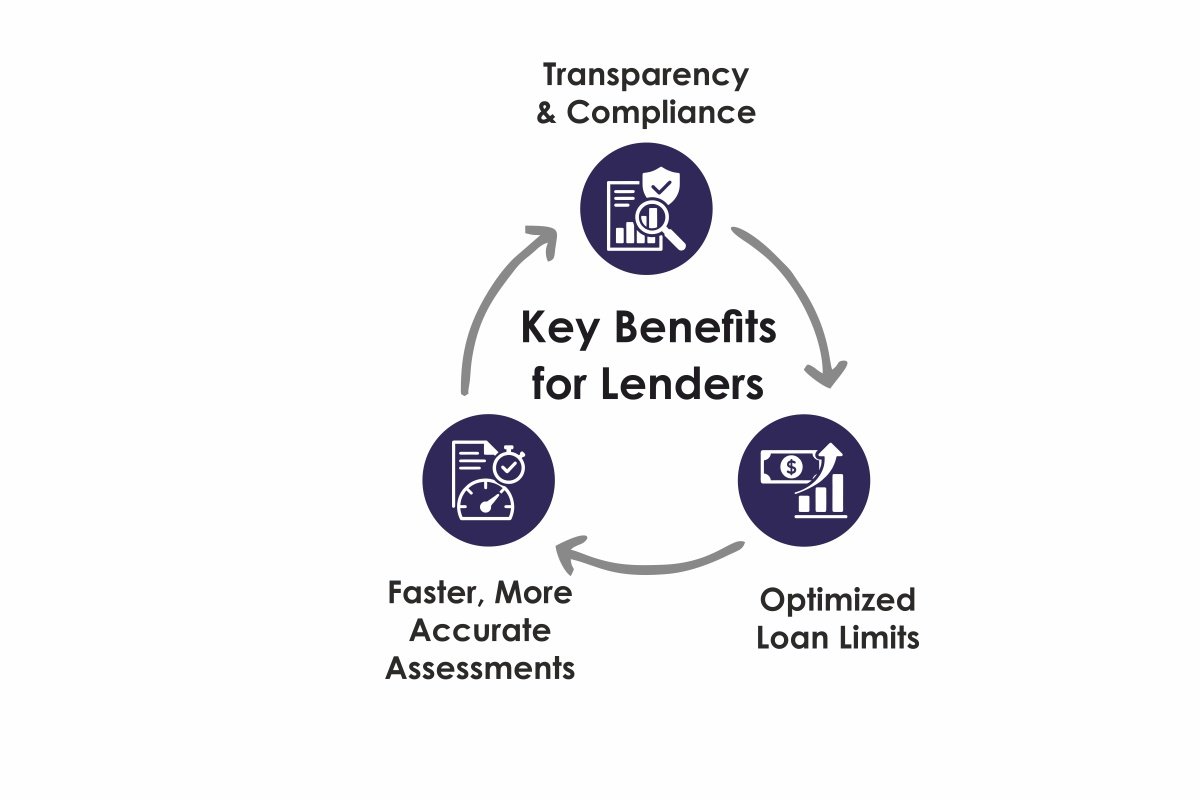

Key Benefits for Lenders:

- Transparency & Compliance: Explainable AI highlights risk factors, ensuring fair, unbiased decisions and regulatory adherence.

- Faster, More Accurate Assessments: AI-powered insights help lenders approve more loans with confidence, balancing growth and risk.

- Optimized Loan Limits: Data-driven recommendations and A/B testing help maximize approvals while minimizing defaults.

AI-powered Insights for Smarter Lending

As lending evolves, traditional credit scores no longer provide a complete picture of borrower risk. Lenders are shifting toward AI-powered insights for better decision-making, efficiency, and compliance.

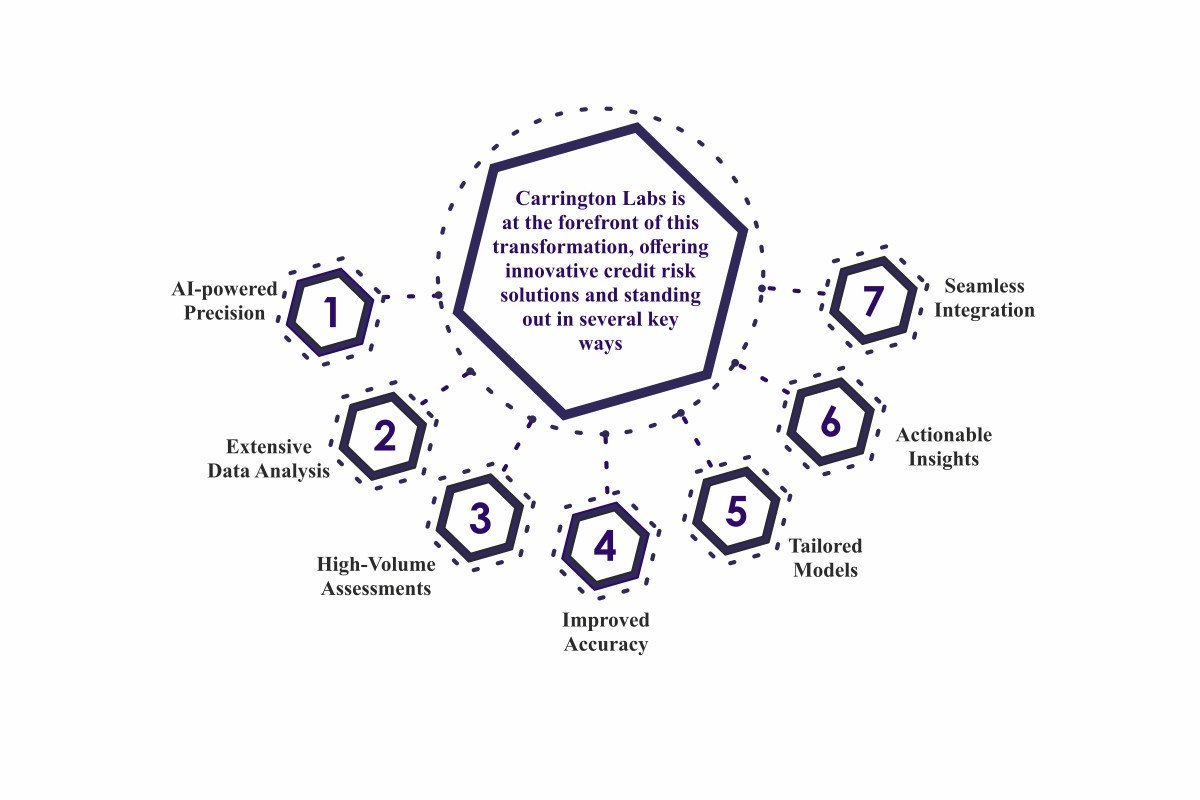

Carrington Labs is at the forefront of this transformation, offering innovative credit risk solutions and standing out in several key ways:

- AI-powered Precision: Uses real-time financial data for a clearer and more accurate credit risk assessment.

- Extensive Data Analysis: Tens of thousands of data points analyzed to enhance lending decisions.

- High-Volume Assessments: Evaluates 40,000+ loan applications weekly with advanced credit risk models.

- Improved Accuracy: Achieves up to 30% greater credit risk accuracy compared to traditional methods.

- Tailored Models: Models adapt to lenders’ specific business needs and goals.

- Actionable Insights: Provides deeper credit risk understanding to inform lending decisions.

- Seamless Integration: Flexible APIs eliminate costly system overhauls.

Empowering Financial Institutions

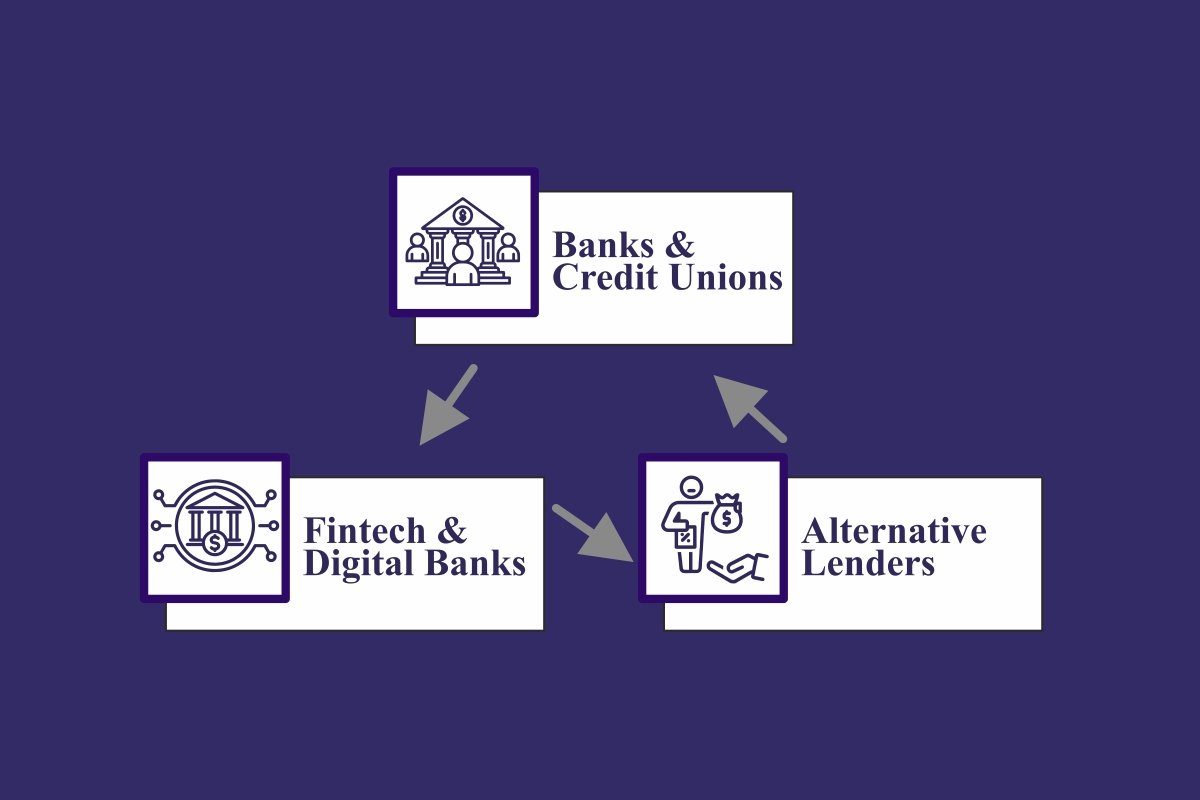

Carrington Labs works with both banks and non-bank lenders to elevate their lending processes and foster financial inclusion.

- Banks & Credit Unions: Helps modernize risk assessment and improve loan offerings.

- Fintech & Digital Banks: Provides tools for more flexible and faster lending products.

- Alternative Lenders: Refines risk models for short-term credit products.

The company customizes its solutions by adjusting credit risk models based on specific loan products, integrating smoothly into existing systems, and providing valuable insights to improve credit decisions.

Expanding Strategic Partnerships

Carrington Labs is actively expanding its partnerships to enhance its credit risk solutions and global reach. The company has been selected for various accelerator programs, connecting Carrington Labs with a vast network.

The company recently partnered with LendAPI Marketplace to accelerate the adoption of modern credit risk technology and make it easier for US lenders to deploy explainable AI credit risk solutions. This launch marks another strategic step in Carrington Labs’ US expansion, creating a direct and seamless path for financial institutions-especially regional banks, credit unions, and fintech leaders-to access the company’s advanced analytics tools.

These collaborations are focused on helping lenders worldwide make better-informed credit decisions.

Commitment to Compliance

Carrington Labs prioritizes compliance, helping lenders navigate evolving regulations while maintaining secure lending practices. With ISO27001:2022 certification and AWS-based hosting, the company upholds strict security and data standards. Its AI models are continuously updated to align with regulatory changes, ensuring lenders remain compliant without frequent system adjustments. Transparency is also a key focus, with explainable AI models that clarify risk score calculations, promoting fair and accountable lending decisions.

To safeguard sensitive data, Carrington Labs employs client-controlled data ingestion, securely accessing transaction histories, application details, and credit bureau reports. This enables tailored credit risk models while maintaining strong data control. Additionally, privacy measures such as excluding personally identifiable information (PII) support regulatory compliance, seamlessly integrating insights into lenders’ workflows.

Key Trends Shaping Credit Risk Management

Jamie shares key trends that will shape credit risk management in 2025:

- Alternative data will play a bigger role, with lenders relying less on traditional credit scores and more on real-time financial data.

- AI will become more important, making credit risk models smarter and reducing the need for manual assessments.

- Instant decision-making will become standard, allowing lenders to assess applications in real-time instead of using lengthy approval processes.

Speeding Up the Lending Process

Jamie explains that AI and machine learning have changed how lenders assess credit risk, making it faster, more accurate, and fairer. Traditional credit scores only look at past borrowing, but AI analyzes real-time financial activity, spending habits, and income stability to give a fuller picture. Machine learning detects patterns and predicts risk more precisely, leading to better decisions. AI also speeds up the process by reducing manual work, so applications can be reviewed in seconds instead of days. This allows lending teams to improve risk models, update policies, and build stronger customer relationships. By considering more financial behaviors, AI reduces bias and helps more people access credit.

Advice for Fair and Transparent Lending

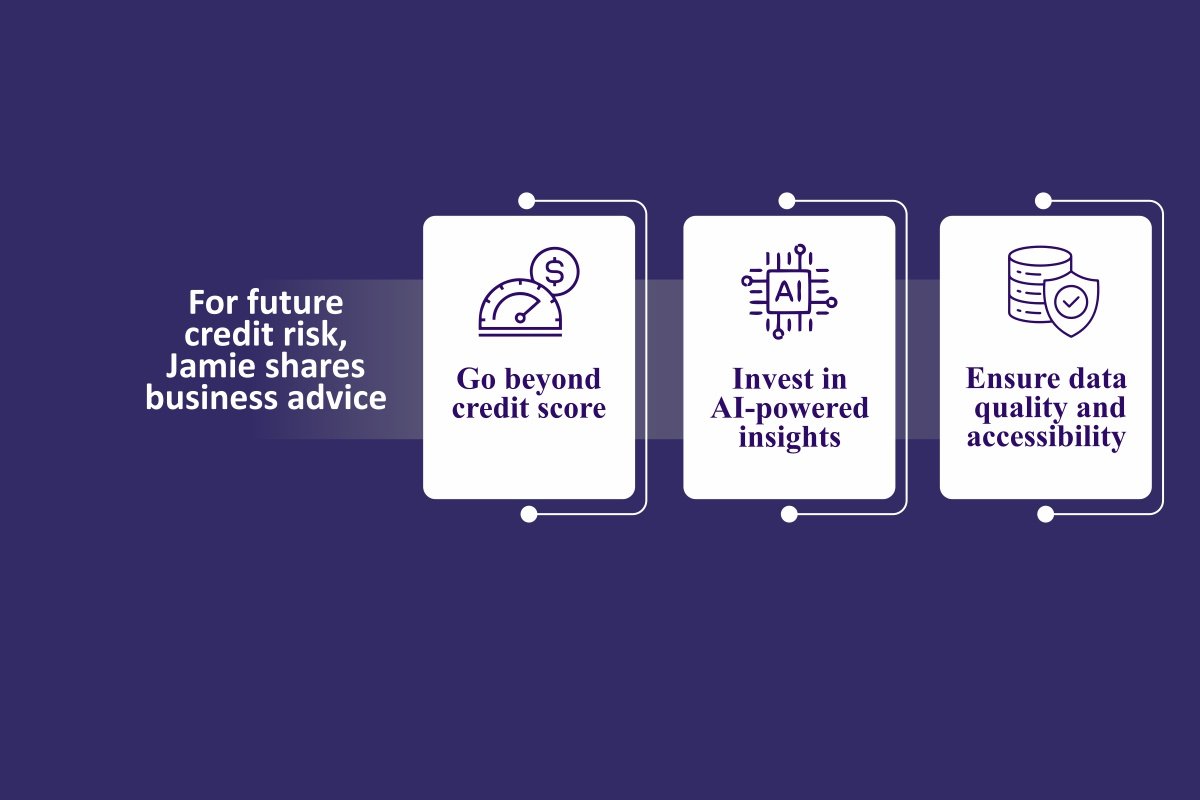

For future credit risk, Jamie shares business advice:

- Go beyond credit score: Incorporate alternative data like cash flow and income stability for a clearer borrower risk assessment.

- Invest in AI-powered insights: Machine learning detects trends traditional methods miss, improving lending decisions and reducing defaults.

- Ensure data quality and accessibility: Ensure well-structured, accessible data to maximize AI’s effectiveness in risk assessment.

Smarter Lending Starts Here! Unlock AI-powered credit risk insights for faster, fairer loan approvals.

Join the future of lending with Carrington Labs.

5 Business Lessons from Carrington Labs

- Rethink Credit Scores: Use traditional bureau data with transaction data for a fuller picture of creditworthiness.

- Build Explainable AI: Replace black-box models with clear, traceable logic.

- Compliance Is Key: Transparent, regulation-aligned AI ensures trust and security.

- Partnerships Drive Growth: Collaborations expand market reach and impact.

- Global Scaling Needs Adaptability: Seamless AI integration optimizes lending worldwide.