The need for a loan can arise for several reasons. First, some borrowers carefully plan the cooperation process with financial institutions, paying attention to studying all parameters of the future loan.

Usually, these are long-term, targeted, and secured loans that you will have to repay over several years or even decades.

Nevertheless, the need for quick loans can arise spontaneously, for example, due to the emergence of unforeseen losses or due to the lack of purchasing a particular product.

As a result, an online consumer emergency loan is one of the most popular and sought-after credit products. It’s present now in almost every financial institution’s service line because demand always generates supply. Moreover, today you can use unsecured bad credit loans.

Types of Emergency Loans

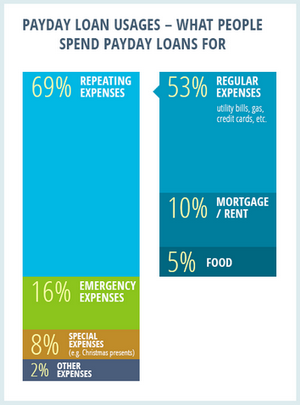

Before you apply for a consumer loan, you should first determine what your immediate needs are. These are payments that you cannot cover in a certain amount of time.

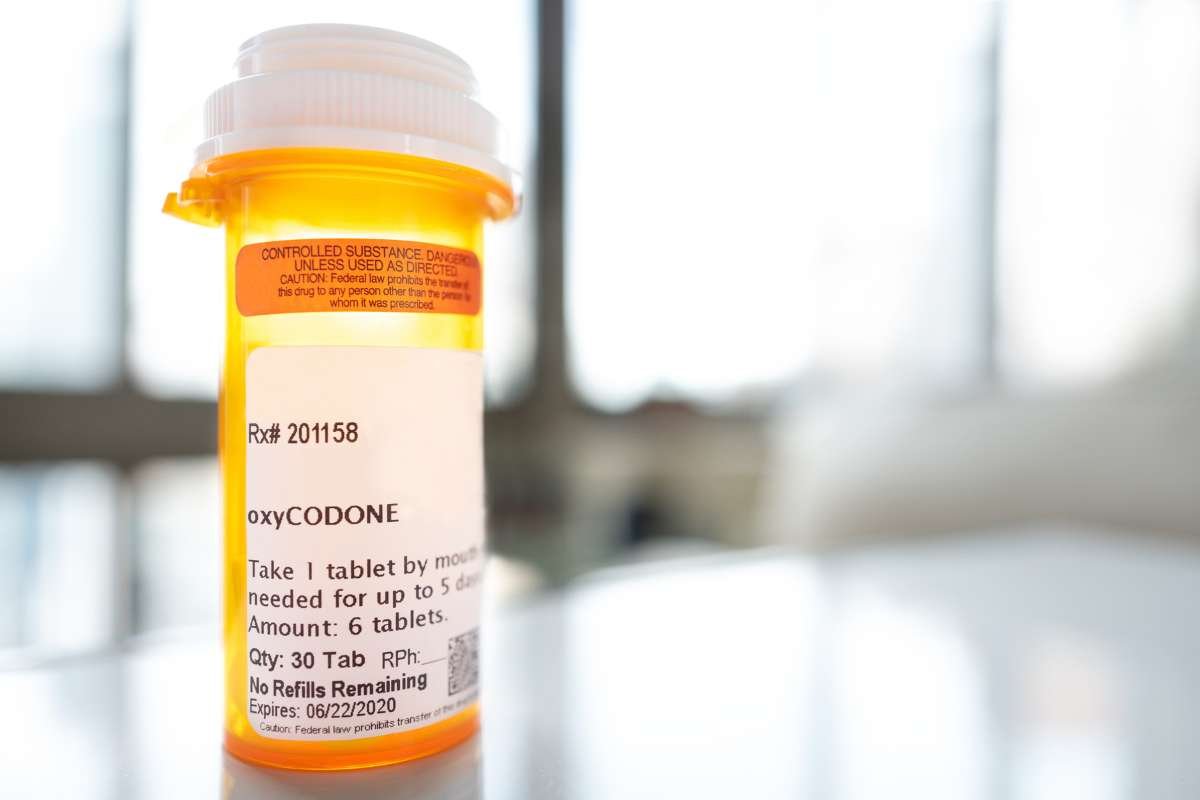

They could be medical emergencies, repairs, or the purchase of a product that will soon go up in price.

Immediate payments are expected for financial obligations. Therefore, lenders strongly advise against using borrowed funds to repay previous loans.

Common uses for consumer loans:

- Payments for medical care and medications.

- Tuition payments.

- Purchasing goods or ordering services.

- Repairs to real estate and appliances.

If taking a loan avoids increased costs or allows you to save time, emergency loans are the best option. In addition, these loans are usually available to the unemployed, students, and retirees.

It’s the ability to present proof of income or any other document certifying your ability to pay that can improve the terms of your loan agreement. For example, if you want to avail an Space Coast Credit Union hero program, you can lower the interest rate, extend the deal’s period, and significantly increase the credit limit.

Nearly half of Americans without emergency loans plan to start saving. But they still apply for a loan in the case of an emergency.

You can get one of the following types of loans for urgent needs:

- Consumer unsecured loan with one document (passport).

- Loan on improved terms for loyal clients of the organization.

- Secured loan with a pledge or guarantee.

- A short-term loan, such as health, travel, or student loan.

- A credit card with a minimum initial limit of funds.

A traditional loan can be arranged by filling out an online application. Lenders have adopted this form of cooperation with clients from microcredit companies.

Therefore, it usually takes up to half an hour to review the borrower’s candidacy, and you can receive received right on the day of application.

Non- Emergency Loans from Microcredit Organizations

All loans from microcredit organizations are instant loans. But interest rates from microcredit companies are higher than those offered by banks. On the other hand, the chance of encountering hidden fees is noticeably reduced.

The average annual interest rate on a consumer loan is about 20%. In addition, you have to pay 0.5-1% for each day of using the funds borrowed from microcredit organizations.

However, working with a microcredit company has a significant advantage. It’s possible to get money here within 30 minutes, whereas banks give emergency loans within a day.

Moreover, if money is urgently needed, you can use the emergency loan option in the form of microcredit. Another reason to work with a microcredit company is that you can get a zero or poor credit history loan.

How Do I Get an Emergency Loan?

The easiest way to apply for a consumer loan is to use an official application. However, it is advisable to apply before the urgent need for funds. Often lenders do additional checks, which also take time.

The application must include:

- Passport information, including current place of registration.

- Contact information (email address and phone number).

- Information about your place of employment and length of service.

- Financial information, in particular the amount of monthly income.

- Personal information (family composition, assets).

- Information about current financial obligations to other organizations.

If the borrower has more than one loan on their account, many lenders provide the option of debt consolidation as part of consumer borrowing programs.

The services benefit borrowers who require funds for urgent needs related to repayment of an overdue emergency loans.

Refinancing to repay the original debts by getting a new loan is considered an additional option. Refinancing involves reviewing the annual rate and adjusting the original repayment schedule.

Important: Some application forms on lenders’ websites require that you specify the purpose of the loan. Such information usually does not affect the result of the application, but you should not ignore the lender’s request or openly deceive the financial institution.

One of the main requirements for every smart borrower is providing accurate, actual, and truthful information supported by a package of documents. You will receive the preliminary decision in a moment.

Requirements for the Potential Borrower

In addition to utmost honesty at the application stage, lenders also require the borrower to meet several primary conditions of the future agreement. Emergency loans cannot be made to persons under 18 years of age.

Bankrupt individuals, unemployed citizens, and potential borrowers with poor credit histories will also have difficulty completing applications. People with disabilities and pensioners have meager chances of obtaining an emergency loan.

The list of basic requirements for borrowers includes:

- An optimal level of solvency.

- No criminal record for economic crimes.

- Stable and official income.

- Permanent registration or, in rare cases, temporary registration.

- At least 90 days of work experience at the last place of employment.

- Total work experience without taking into account place of employment more than one year.

- The positive state of credit history.

- Absence of overdue payments in the presence of existing loans.

How to Increase Your Chances of Getting a Emergency Loan

Optional but recommended requests from the lending institution often include no loans from other lending institutions. The only exceptions are credit cards.

To get a loan, you sometimes have to deal with an insurance company. Still, many institutions now waive this condition, offering the customer a reduced interest rate in exchange for purchasing an insurance policy.

References Only to Reliable and Verified Sources

By providing data at the application stage, the potential borrower agrees to process confidential information. You should not fill in forms on suspicious sites.

Potential borrowers who share personal information through web resources unprotected by security certificates voluntarily submit sensitive data to intruders.

To increase the chances of obtaining a favorable loan will help:

- taking out insurance;

- applying for a loan through an application;

- attracting a co-borrower;

- securing the deal;

- expanding the package of documents.

If the borrower refuses to participate in measures to guarantee the debt repayment, no interest rate reduction can even be discussed. Moreover, loans for urgent needs are given only under the client’s responsibility, so you will have to moderate your financial appetite.

Important: Repaying an emergency loan is no different from paying off any other loan. You can make regular payments at bank branches, self-service terminals, and payment systems, including electronic wallets and popular Internet banking services. Early loan repayment always allows you to save money.

As a result, a loan to meet various needs is one of the most affordable and versatile forms of borrowing. Usually, the money is granted for a maximum of five years, but you need to provide additional guarantees to improve the loan terms significantly.