Bad credit loan means that you can access a loan with a short credit history or low credit score. Remember that things like maxed-out credit cards or late payments can sometimes lower your credit score. Loans for poor credit or bad credit can be a good option for those whose credit shows financial problems or those who may not haven’t had enough time to create a credit history.

Bad credit loans can either be secured, meaning they are backed by collateral like a car or home or unsecured. This page explains everything you should know about a bad credit loan.

Types of Bad Credit Loans

It’s worth noting that the fees, interest rates, and terms of bad credit loans can vary by lender. Various credit unions, banks, and online lenders provide these loans to lenders with bad credit, though the threshold for what’s regarded as a creditworthy borrower can vary by institution.

You can find some lenders that have stricter requirements than others, making it crucial for you to shop around carefully when searching for a loan. That said, you can find two key options available for bad credit loans. You can get either secured loans or unsecured loans.

Secured and Unsecured Loans

You can get secured or unsecured loans when it comes to loans. Secured loans need collateral, such as a car or home. In most cases, lenders can give you more favorable terms and rates and even higher loan limits because there is greater incentive that you can repay the loan timely. And, if you have poor credit, it can be easier to access a secured loan than the unsecured one.

Here is the deal, if you default on the secured loan, you risk losing a car, home, or any other collateral. The common kinds of secured loans include home equity loans, mortgages, and auto loans, though you can find some lenders that provide secured loans.

On the other hand, you don’t need collateral for unsecured loans don’t need any collateral. Even better, the rate you can get usually depends on your creditworthiness. This means it can be more difficult to qualify for these loans if you have poor credit scores. Because it’s not secured by any asset, this loan usually comes with lower loan limits and higher interest rates. The good news is that you don’t risk losing the assets if you fail to repay the loan.

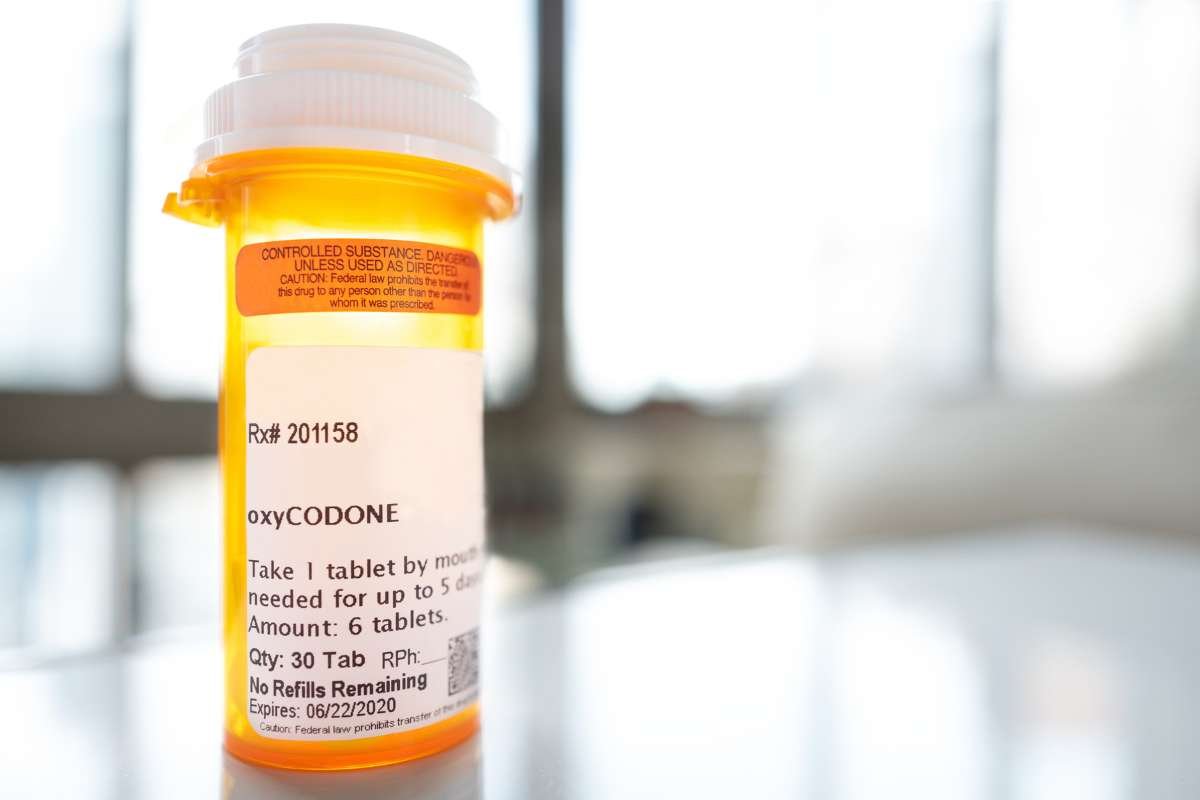

Payday Loans

Payday loans are simply short-term loans that usually attract high fees. The good thing is that you can get fast money and repayment can be due by the next paycheck. See if you are eligible for a £5000 loan.

Another good thing is that payday loan lenders sometimes don’t do credit checks, making them easier to be approved compared to the other forms of loans. Keep in mind that the overall cost of borrowing can be high, so you need to weigh your options first. Above all, you need to find a lender that offers great terms, interest rates, and fees.