The stock market is full of options that we most times fail to end up with the right ones. Therefore, this piece of content is here to help you choose the correct trading platform for your stock market investments. A trading platform plays a vital role in your investments, and when you have the right option, you can go a long way with amazing returns.

But here are some basics you would have to know before starting to choose your trading platform;

What is the Meaning of a Trading Platform?

A trading platform is an online trading system that executes deals in a networked environment using computer software. Depending on the financial intermediary, trading platforms can be used for free or at a reduced cost.

Traders can use trading platforms to keep their accounts funded and make restricted trades. Investors use platforms to maintain funded accounts and trade securities on numerous exchanges. To improve security, information transparency, and secondary market liquidity, optimal trading systems should use complex architecture databases.

The network-based environment enables traders to communicate satisfactorily, apply appropriate search criteria, and electronically bargain with offers based on transaction parameters and other terms and conditions in order to satisfy both parties.

Types of Trading Platforms

Prop (proprietary) trading platforms and commercial platforms are the two types of trading platforms. Large brokerage firms create software for prop trading platforms that mimic the trading style and needs of electronic brokerage models.

Commercial platforms, on the other hand, are aimed at retail investors and day traders. Commercial trading platforms are simple to use and provide useful tools such as charts and news feeds to help investors and traders do research and provide more insightful information.

Active trading necessitates the use of numerous trading tools and approaches for identifying trends. Choosing the best trading platform necessitates hands-on expertise with active trading.

Now, let’s get to the methods of choosing the best trading platform in India.

Choosing a Perfect Trading Platform;

Here are some things that you need to follow in order to end up with the best trading platform:

1) A Global Presence

Every trader would like to trade equities in global markets, which is impossible without a platform that provides international access.

2) Accessibility

We don’t keep our phones out of our hands anymore. That’s why we’re looking for the finest software to help us manage our grocery list, order food, and conduct online transactions.

As a result, we require the chosen platform to match our lifestyle; hence, the ideal platform provides you with the convenience and accessibility to trade online from mobile phones, at any time, and from any location.

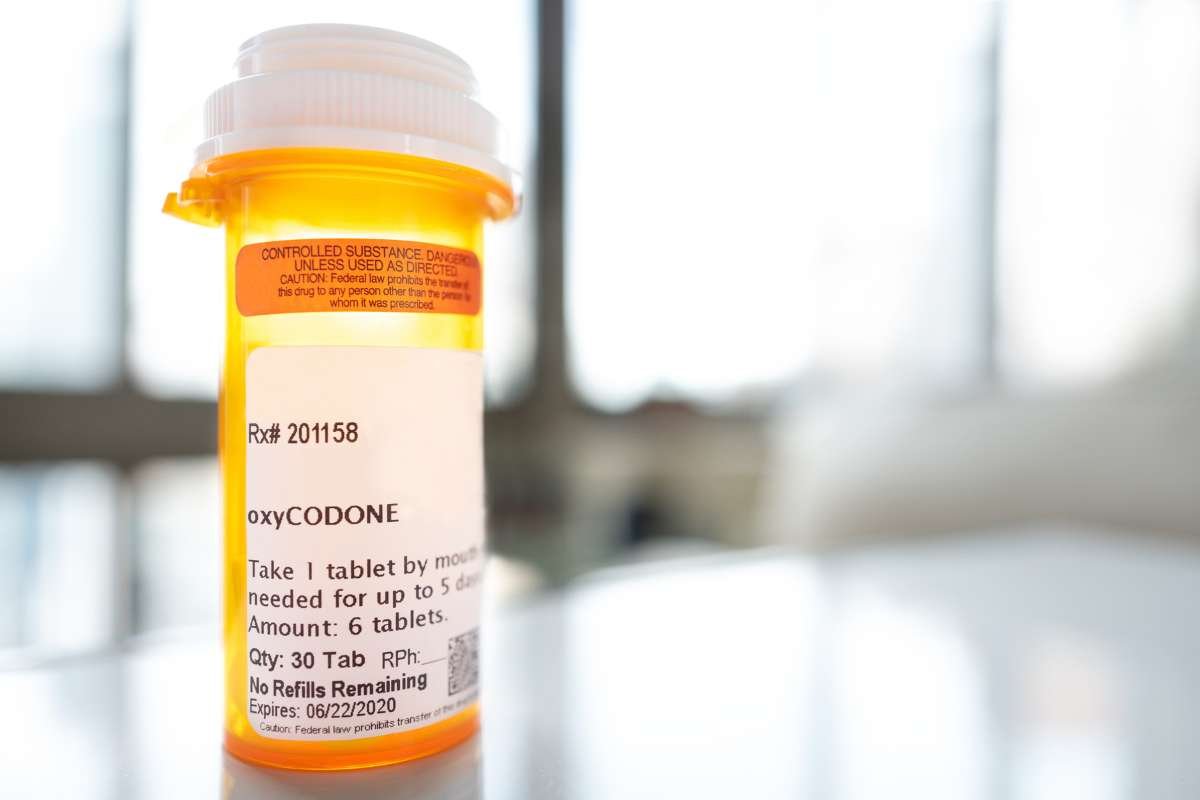

3) Fees and Charges

It is commonly understood that the primary consideration in making any decision is its cost. When shopping online, verify the transfer fees and whether there are any hidden fees or commissions before selecting any item.

Similarly, while trading online, it is critical to evaluate the fees and charges paid, which differ between trading platforms. Some platforms charge a flat fee per trade, while others charge a percentage of the deal value.

This also holds true for commissions, which brokers will undoubtedly charge you anytime you purchase or sell stocks. Unfortunately, the fees and commissions you pay have a significant impact on your overall profitability and returns. However, the good news is that certain platforms provide low-cost trading with no commission.

4) User-Friendly

Examine the platform and see if the overlay appeals to you at first glance. If the answer is “No,” you should look into other options. To function efficiently with any online trading platform, you must understand its complexities. When you open the website, you should be able to see the basic icons and options.

5) Features

Your best online trading platform should be appropriate for your current trading circumstances. To learn quickly, it is usually advisable for beginners to start with something simpler. If you want to improve, your platform should provide everything you need. As a result, finding a platform with a strong product offering is critical.

6) Performance Stability

Ascertain that a platform is compatible with your program. You must be certain that a platform’s performance will be reliable and smooth. This is one of the most crucial and significant aspects of trading.

7) Customer Support

Your broker should be able to operate with the platform that you select. Not only should you be quite familiar with the platform, but so should the rest of the team. You are now ready to select a new trading platform.

8) Your Needs

Although this is the last point, it is likely the most important point that you have to look at. Before you consider all of the points that are mentioned above, you would have to be considering this one. Your needs make you decide what you need out of a platform. For instance, when you are an investor in the stock market, your needs differ from when you are a trader in the stock market. Whatever your needs are, you would have to be analyzing your financial and investment needs first.

Boost Yourself More On A Beginner’s Guide to How Do Online Trading Platforms Work?

Conclusion

Other methods for assessing and comparing different platforms include reviewing various procedures such as feedback ratings and customer reviews; however, keep in mind that not all reviewers are devoid of prejudice or independence. But make sure you use the right tips to get the right trading platform and start trading right away.