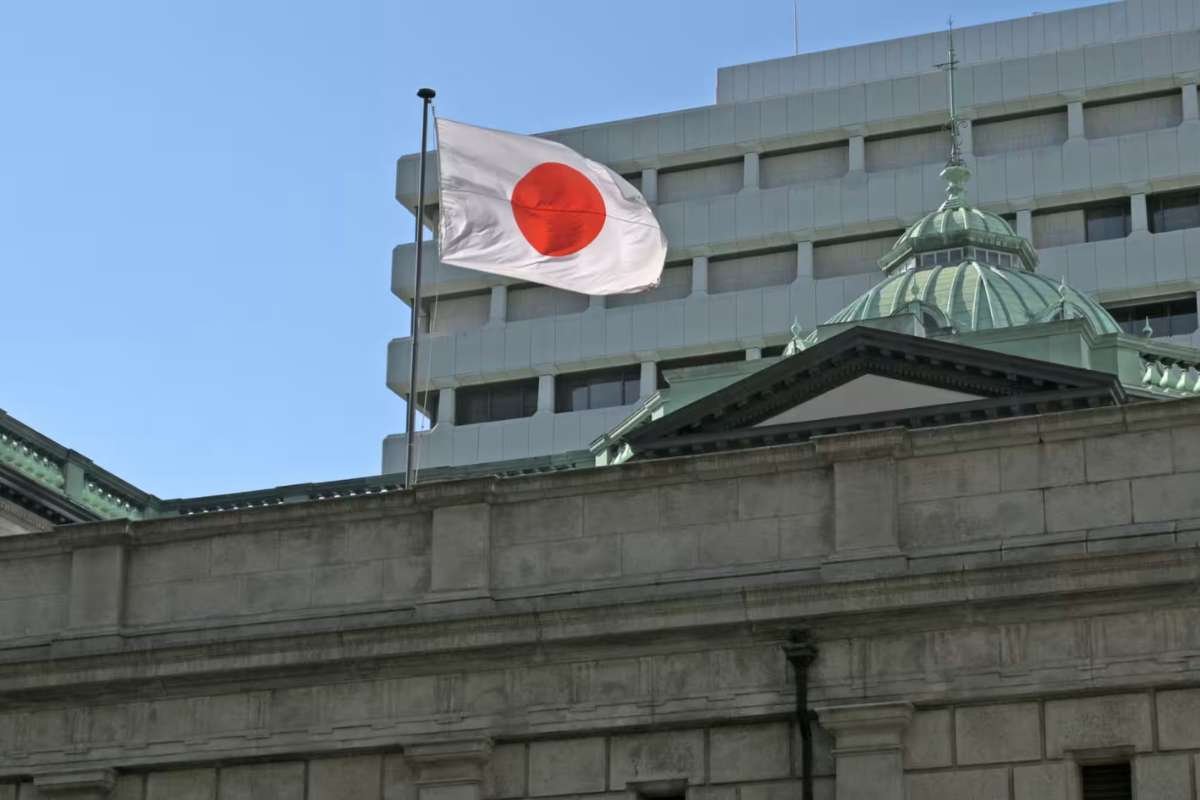

Japan’s central bank has taken another decisive step away from decades of ultra-loose monetary policy, raising its benchmark Japan interest rates to the highest level seen in nearly 30 years. The move underscores growing confidence among policymakers that inflationary pressures are no longer temporary and that the economy is strong enough to absorb tighter financial conditions.

The rate increase follows a prolonged period during which Japan relied on near-zero and negative interest rates to combat deflation and stagnant growth. With consumer prices consistently running above the central bank’s 2% target and broader economic indicators showing resilience, officials signaled that the era of emergency-style monetary support is firmly coming to an end. While the absolute level of rates remains low compared with other major economies, the shift is significant given Japan’s long history of accommodative policy.

This adjustment also reflects changing domestic dynamics, including stronger corporate pricing power and improving demand conditions. Policymakers emphasized that inflation is no longer being driven solely by imported costs but is increasingly supported by internal economic factors.

Central Bank Outlook and Policy Direction

Central bank leadership indicated that the latest rate hike does not mark the end of policy normalization. Officials stressed that future decisions regarding Japan interest rates will be guided by incoming data, particularly trends in inflation, wage growth, and overall economic momentum. Although interest rates have reached a multi-decade high, real rates remain negative when adjusted for inflation, leaving room for additional tightening if conditions warrant.

Wage growth remains a key focus. Sustained increases in pay are viewed as essential to maintaining stable, demand-driven inflation and reducing Japan’s historical reliance on monetary stimulus. Policymakers acknowledged that while progress has been made, they will continue to monitor whether wage gains are broad-based and durable.

The central bank also addressed currency movements, noting that a weaker yen has contributed to higher import costs and consumer prices. While exchange rates are not a direct policy target, officials recognized that currency stability plays a role in shaping inflation expectations and business confidence. Overall, the message from policymakers was one of cautious optimism, paired with a willingness to act further if economic conditions continue to evolve favorably.

Market Response and Global Implications

Financial markets reacted calmly to the announcement, suggesting that investors had largely anticipated the move. Japanese equities showed resilience, while government bond yields edged higher as markets adjusted to the prospect of a gradually tightening Japan interest rates. The yen experienced modest fluctuations, reflecting a balance between higher domestic rates and global currency dynamics.

The policy shift carries implications beyond Japan’s borders. Higher Japan interest rates reduce the attractiveness of strategies that rely on borrowing cheaply in yen to invest in higher-yielding assets abroad, a practice that has influenced global capital flows for years. A gradual unwinding of such positions could affect currency markets and asset prices in other regions.

Despite these potential spillover effects, global investors appear confident that Japan’s policy transition will be orderly. The move aligns Japan more closely with the broader trend among major central banks toward recalibrating monetary policy in response to persistent inflation. For now, markets are watching closely for signals on the pace of future rate increases and how Japan balances growth, inflation, and financial stability in the months ahead.

Visit more of our news! The Enterprise World