India is considered as the 7th largest economy globally, and is also one of the leading countries that demonstrates high economic year-on-year growth. Now, as opposed to China, economic growth of India has been primarily driven by domestic consumption. In conclusion, rural India indeed plays a crucial role, considering two-thirds of the population resides in small towns and villages.

The 2008-09 slowdown had a huge impact on the urban residing population. But the year 2009 onwards, there have been many factors that have led to an increase in the rural purchasing power. This impact has been brought forward by technologies such as the internet, mobile phones, and satellite TV, which have made the rural consumer well-connected and aware of things happening all over.

But, bridging the gap between rural and urban still remains as a big challenge. To this, financial inclusion plays a key role. Inclusive development provides people with access to better financial facilities and improves people’s lives.

One such leader taking strides to bridge this gap is Ms. Padmaja Reddy. Featured in The Enterprise World’s this issue of The Most Influential Women Leaders in Business to Watch in 2024.

Leading the Way!

In 1998, Ms. Padmaja Reddy established Spandana, a Micro Finance Institution, which grew to become the second-largest Microfinance Institution by the year 2009. The firm had planned on bigger things when the Andhra Pradesh Government implemented an ordinance, which then brought all the microfinance activities in the state to a standstill.

As a result of this, all of Spandana’s portfolio deteriorated, thus forcing the firm into Corporate Debt Restructuring (CDR). The company’s net worth plummeted to a negative 1,400Cr. With unwavering determination, perseverance, and passion, the Institution successfully emerged from the CDR process. Within three years post-CDR exit, their Assets Under Management (AUM) increased eightfold, and the net worth rebounded from negative 1,400Cr to 2,300Cr. Spandana was eventually listed in 2019.

The Business once again faced a major setback due to the impact of COVID-19. Micro Finance, as a monoline product, proved highly susceptible, experiencing crises every three to four years.

“Reflecting on my nearly 22 years in this industry, I couldn’t help but think that if I had invested the same effort in a less vulnerable business, it might have experienced exponential growth.”, adds Ms.Reddy

While proud to be one of the pioneers in this emerging industry, there remains a sense of dissatisfaction due to the inability to build a more sustainable and stable business.

“This dissatisfaction fuelled a more sustainable and stable business.”

Thus far, the journey has been relatively smooth, with no major challenges in leading the company. However, there is a continuous focus on scaling the business, institutionalizing systems and policies, establishing layers of leadership, and optimizing technology adoption, a set of critical areas the team has been actively addressing.

Setting Sail in the Tough Times

Staunch leadership becomes a crucial part to successfully run a financial institution. Partaking this huge responsibility to bridge the very necessary gap was a challenge indeed for Ms.Reddy. But with her ethics and principles, she has today been able to stand strong despite all the challenges.

“My leadership philosophy centers on leading by example, and I strive to instill this principle at various organizational levels,” she further adds.

Ms.Reddy is a firm believer in the pursuit of excellence, emphasizing that everything the firm undertakes should be executed with exceptional quality. Regardless of the business sector, her aspiration is to consistently occupy a position, which enables her to provide employement and help low income households to cross the poverty line.

“Ethics and high integrity are paramount values in my leadership approach.”

Ms.Reddy makes sure that she adheres to these principles to her core and ensures that every stakeholder within the organization upholds these fundamental values. By embodying these principles and fostering a culture of excellence, she aims to create a work environment where leadership is synonymous with integrity and the relentless pursuit of excellence.

Overall Impact:

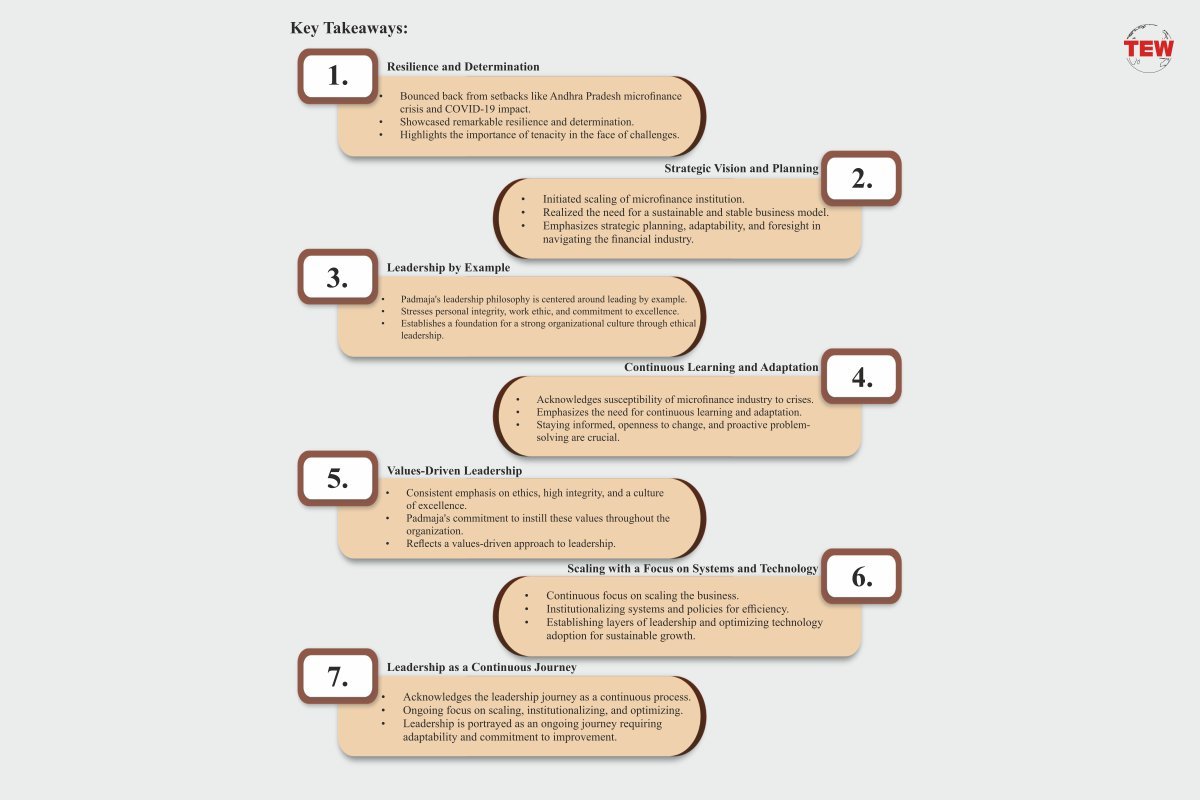

Padmaja Reddy’s journey underscores the challenges in the financial industry and the significance of resilient leadership, strategic vision, values-driven decision-making, and continuous learning.

About Keertana Finserv Private Limited

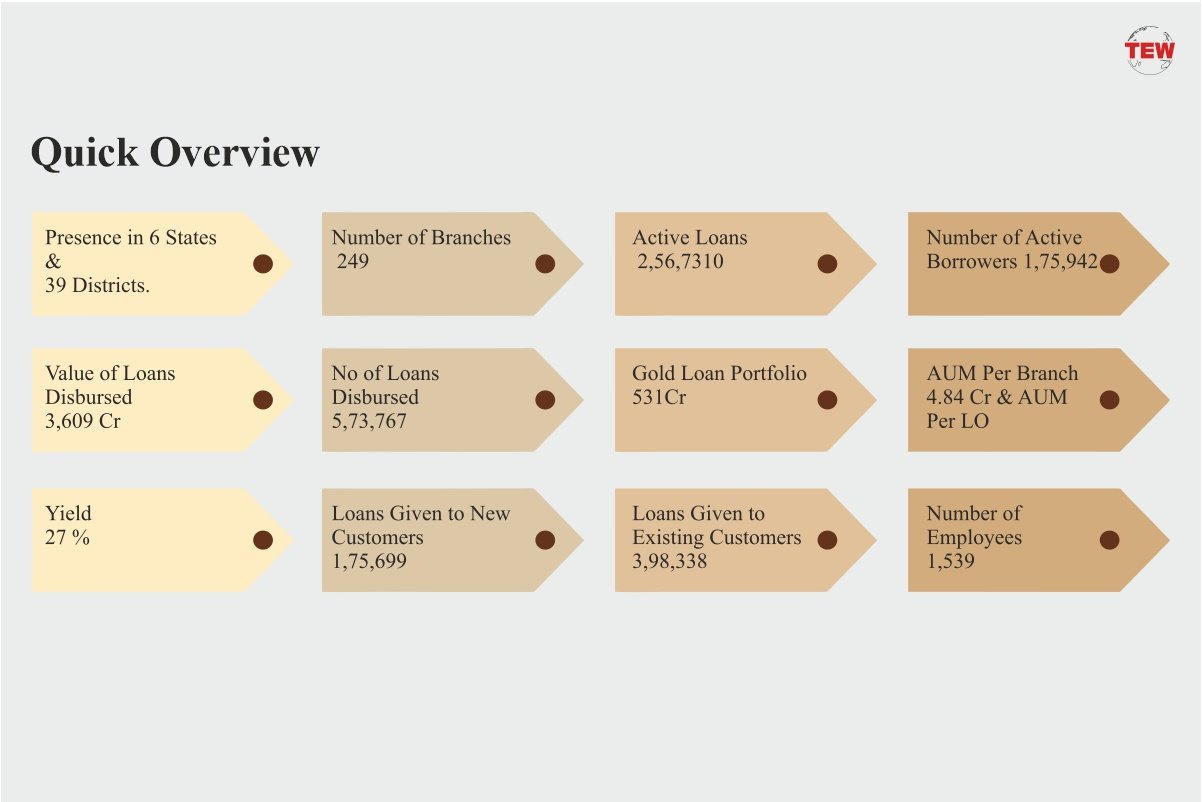

Keertana Finserv Private Limited, formerly known as Rajshree Tracom, emerged as a prominent Non-Banking Financial Institution (NBFI) in South India. Initially started out as a business, the firm later came to be recognized for its keen attention and services catering to the financial needs of the lower and middle-income segments. The firm swiftly rose up the ranks and has today become a key player in the industry with an AUM of 1,205Cr by Dec 23.

Ms. Padmaja Reddy Promoter and Managing Director of Keertana Finserv, took the helm in April 2022. With a formidable background in financial services, her leadership has been instrumental in the company’s remarkable growth. Prior to joining Keertana, Ms. Reddy served as the Managing Director of Spandana Sphoorty Financial Limited, a significant Microfinance Institution in India, which grew to the second largest MFI in India during Ms.Reddy’s stint. She is the Founder and promoter of Spandana and was the Managing Director for 20 years.

Challenging the Challenges

Join Keertana Finserv on its early journey in 2022, where it faced the constant need for money, be it loans or investments, and a unique challenge of not having a long track record. This info graphic tells the story of how Keertana cleverly dealt with these issues, highlighting its strength in getting funds, standing out as a special case, and handling talent needs all at once. See how Keertana turned challenges into opportunities, bringing in many supporters and ensuring steady growth for the business.

Initial Phase

Capital Need:

- Constant need for capital (debt or equity).

- Lenders have stringent criteria (rating, vintage, demondtarated track record of profitability).

Lack of Vintage:

- Started operations in 2022.

- Absence of a substantial vintage.

- Unique challenge in gaining lender attention.

Navigating Funding Challenges

Exceptional Case Positioning:

- Despite no track record, positioned as an exceptional case.

- Business never slowed down for lack of funds

- Growth, financial performance, mix of secured and unsecured lons as a strategy and world class IT and highest level of transparency attracted numerous lenders.

Success in Attracting Lenders:

- Overcame initial hurdles.

- Successful attraction of numerous lenders.

- Funding is no longer a hindrance.

Talent Acquisition Struggles

Ongoing Talent Acquisition Challenge:

- Acquiring the right talent is crucial.

- Remaining an ongoing challenge for Keertana Finserv.

- Simultaneously addressed along with funding challenges.

Proactive Approach:

- Positioned itself as a great platform for someone aspiring to build wealth and be part of the senior management;

- Providing ample growth opportunities.

- Fostering an employee-friendly environment.

- Holistic approach to talent acquisition and retention.

Key Takeaways:

Resilience in Funding:

- Overcame initial funding challenges.

- Positioned as an exceptional case.

- Successful attraction of numerous lenders.

Simultaneous Talent Management:

- Addressing talent acquisition alongside funding challenges.

- Proactive measures for employee growth and retention.

Business Growth Despite Challenges:

- Business never slowed down in initial quarters.

- Growth and financial performance as a testament to success.

Overall Impact:

Keertana Finserv’s journey highlights resilience in funding, proactive talent management, and sustained business growth despite initial challenges. The strategic positioning and proactive measures contribute to its success story.

Keertana’s Suite of Products and Services

Keertana Finserv strategically caters to the financial needs of low-income and middle-income households, providing a diverse array of financial products such as Micro Enterprise Loans, Business Loans, Gold Loans, Loan against Property, and Housing Loans.

“Our distinctiveness lies in our dedicated focus on rural areas, particularly the interior and remote regions where financial services are sparse.”

Operating with a commitment to fairness and ethical conduct, Keertana Finserv ensures that its employees are not only skilled professionals but also trained to remain grounded, treating customers with utmost respect and dignity. This approach is pivotal in establishing strong and trustworthy relationships with the clientele.

How it Works?

Gold Loans

- Loans are given against pledge of gold;

- Range of products with a wide choice of interest rate, Loan to Value (LTV) loan tenor, interest payment frequency;

- Branches set up in remote rural regions, where Gold Loans penetration is almost negligible;

- Superior infrastructure with Security Alarm Systems, CC Cameras and Control Centre at Corporate Office holding digital key for the Vaults in Branches;

- Excellent customer experience with quick service

- No restrictions on Pledge release and partial release of Gold is possible;

- Over Rs.6Cr portfolio built at Branch level in a short span of six months;

- Checks and controls built at the Branch level with Sales Team not involved in Gold Appraisal;

- Internal Auditor visiting Branches atleast once a week;

- Interest rate ranges from 0.66% to to 2% pm.

- Loan tenor ranging from 3 months to 12 months

- LTV Ranging from 60% t 75%

- Loan Size starting with Rs.1K to 1Cr

Micro Enterprise Loans

- Targeting Low income and middle-income households;

- Target segment includes daily wage laborers, skilled labor, factory workers, private employees, small business owners, small and marginal farmers, tenant farmers and Class IV Government Employees

- Loans size ranging from Rs.30K to Rs.1L.

- Loan tenor –2 years

- Loan is sanctioned on the basis of cashflows and Loan repayment track record

- 30% rejection rate eliminating Borrowers, who have no repayment capacity

- Rule Engine is automated and loan sanction / rejection is fully automated;

- Focus on rural areas, where NBFC penetration is low;

- Quick turnaround time

LAP & Home Loans

- Loan Size ranges from Rs.2L to 50L

- Loans are Secured by hard collateral – residential or commercial property

- Loan is disbursed in less than a week’s time

- Loan Tenor ranges from 3 years to 10 years

What the Future Holds?

Keertana Finserv is a Non Banking Finance Company that stands out by offering different kinds of loans – somewhere you need to provide security, and others where you don’t. This makes Keertana unique because many other companies in this industry focus on just one type of loan. Keertana’s smart way of doing things helps it stay strong, grow, and make a profit.

In just 20 months, Keertana has become a big player in the market, known for doing a great job in a tough industry. They offer loans ranging from INR 20,000 to INR 20,00,000, carefully managing the strangeths and weaknesses of each loan they provide.

Looking ahead, Keertana has big plans – they want to open twice as many branches in the next two years and make their business five times bigger. This shows how serious they are about reaching more people and making their services available to a larger audience.

Keertana Finserv is like a success story, proving that with hard work, commitment, and the right mindset, you can achieve great things. It’s an inspiration for all of us, encouraging us to keep going and aim high to make our dreams come true.