Credit scores are something we all have when we start using credit. As soon as you obtain a credit card, enter a hire-purchase agreement, or even take on a property lease, you begin building a payment history, whether it’s good or bad.

Despite credit scores not being something we need to pay much attention to regularly, they can be pivotal for our ability to secure competitive personal or business funding. You might be able to ensure your credit score is as high as you need it to be by avoiding making these common but critical mistakes:

1. Not Making Any Effort to Improve It

If you’ve noticed that your credit score is not as high as it could be, the most straightforward course of action is none at all. However, that can prove troublesome should you decide to take out a personal, business, or home loan in the future.

At a minimum, it can be in your best interest to look at ways to improve your score, such as reading a tradeline supply company review before purchasing tradelines, having incorrect information removed from your credit report, and paying your bills on time.

2. Making Minimum Payments

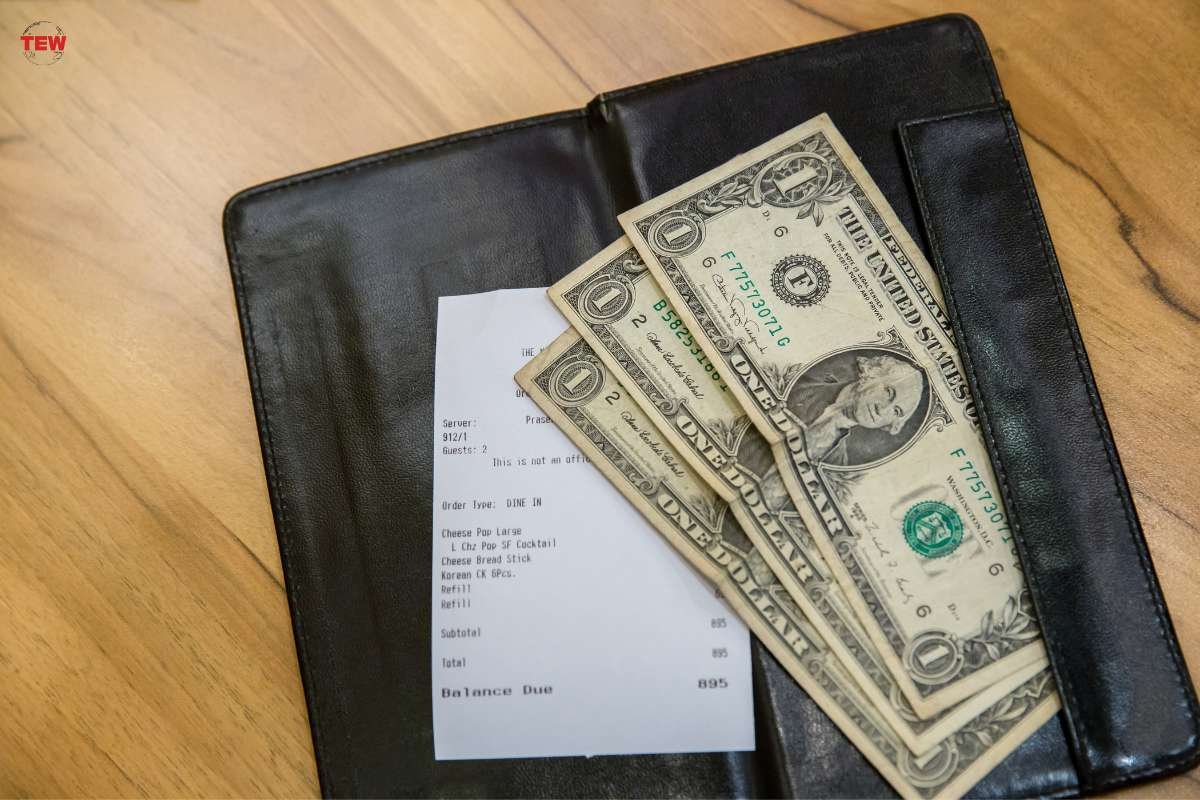

When you receive a bill from your credit card company asking you to make a minimum payment of a certain amount, you might assume that’s all you need to pay to continue paying down your purchase.

However, making minimum credit card payments may damage your credit score. The payments themselves aren’t the problem, but their impact on your credit utilization rate might be. In many cases, minimum payments can result in a high credit card balance, meaning your available credit is less than you owe. If this exceeds approximately 30%, there’s potential for your credit score to decrease.

3. Not Paying Your Bills On Time

Life gets busy, and bills you receive in the mail and via email can easily slip your mind. Late payments might not seem like a big deal, but they have the potential to wreak havoc on your credit. While making a payment within the 30-day late window will generally only result in potential fees or penalties, accounts that remain unpaid after that timeframe may impact your credit score. Late payments also stay on your credit report for seven years.

If you struggle to remember to pay bills on time, set a reminder on your mobile device or calendar. If you’re in financial strife and unable to make the required payments, talk to your lender about appropriate solutions.

4. Closing Your Credit Card Account

Closing a credit card account you no longer use might seem like the most financially responsible decision to make. However, if that account is in good standing with no history of late or missed payments, you might be doing your credit more harm than good by closing it. Closing a credit card means you lose the credit available on it, potentially increasing your credit utilization rate and temporarily harming your credit score.

Your credit score might not be something you need to think about every day, but it can be worth giving your attention when the time comes to take out a loan. Avoid making these mistakes above, and you might enjoy a much higher credit score than you anticipated.