What if you reached retirement and realized you weren’t sure whether your savings would last—or whether you had made the right financial choices along the way? That kind of uncertainty can be deeply stressful, leaving many people worried about their future instead of enjoying it.

Proper retirement planning is essential to creating a steady income, making sound decisions, and maintaining the freedom to live life on your own terms—without constant financial worry.

Thomas B. Hamlin, CEO & Founder of Somerset Wealth Strategies, LLC, creator of AnnuityFYI, and host of the Conquering Retirement with AnnuityFYI podcast, has dedicated his career to changing that experience. He leads his companies and media platforms with a singular focus: to make complex financial topics—especially annuities—clear, accurate, and truly useful for individuals planning their retirement.

By overseeing the development and organization of educational content, guiding a team of writers, researchers, and financial experts, and speaking directly to listeners through his podcast, Thomas Hamlin ensures that the information people rely on is trustworthy, relevant, and accessible. The result is a set of resources that help users make confident, well-informed decisions about their financial future rather than feeling pressured or confused.

One of his most notable achievements is building AnnuityFYI, a comprehensive, consumer-focused educational platform that simplifies retirement planning for a wide audience. Alongside Somerset and the podcast, this ecosystem has empowered thousands of individuals to move toward a more secure, less stressful retirement.

Founding Roots & Origin Story

AnnuityFYI and the Somerset family of companies were built on Thomas Hamlin’s vision as a nationally respected annuity expert and retirement planning specialist with more than 35 years of experience. Early in his career, Thomas Hamlin recognized a serious problem in the financial industry:

People approaching retirement often felt overwhelmed, uncertain, or pushed toward products that seemed to benefit advisors more than the individuals they were meant to serve.

He wanted to change that dynamic and create something genuinely helpful, something that would prioritize clarity, fairness, and the consumer’s best interest.

That journey began in 1997, when Thomas Hamlin founded Somerset Wealth Strategies in the Portland, Oregon area. Over time, that single firm grew into a family of specialized companies:

- Somerset Securities, Inc., a long-standing SEC-registered broker-dealer and member of FINRA/SIPC, originally founded in 1963 and acquired by Thomas Hamlin in 2013. It now serves as the group’s securities platform, handling brokerage and alternative investment transactions.

- Somerset Wealth Management, LLC, a fee-based fiduciary advisory firm focused on AUM-based wealth management and institutional-style portfolio management.

- Somerset Wealth Strategies, LLC, which specializes in fixed and fixed indexed annuities, life insurance, long-term care solutions, and other non-securities-based retirement strategies.

Together, these entities give clients access to a coordinated set of capabilities across securities, advisory, and insurance-based retirement planning, anchored by a consistent philosophy and leadership team.

At a time when straightforward, consumer-friendly information was rare, Somerset stood out for putting transparency, education, and client-first values at the core of its work.

As Somerset grew, Thomas Hamlin realized that people needed more than one-on-one guidance. They needed free, unbiased information they could access at any time, on their own terms.

This insight led to the creation of AnnuityFYI, a direct-to-consumer educational platform built on a simple philosophy: Educate first. Recommend second. Never put our interests ahead of yours.

AnnuityFYI: Unbiased, Easy-to-Understand Financial Guidance

AnnuityFYI is an online educational platform designed to help individuals make informed decisions about annuities, retirement income, and long-term financial planning. In an industry that can feel overwhelming and full of jargon, AnnuityFYI focuses on clear, unbiased, easy-to-understand guidance.

Its core purpose is to simplify complicated financial concepts and give people the confidence to take control of their retirement planning.

AnnuityFYI focuses on several key areas of financial education that help users understand how annuities fit into a broader retirement strategy, including:

- Understanding different types of annuities

- Comparing annuity features, benefits, and limitations

- Learning about income planning strategies

- Exploring lifetime income options

- Identifying tax-deferred growth opportunities

- Assessing market-linked annuity structures

- Evaluating risk factors and suitability considerations

By providing clear and practical insights in these areas, the platform helps users see how annuities can support their long-term financial goals while addressing important concerns such as income stability and longevity risk.

Whether someone is researching income annuities, indexed annuities, or other fixed annuity products, AnnuityFYI provides reliable, professional, and consumer-focused information that supports retirees, pre-retirees, and financial advisors alike.

Somerset: The Foundation Behind the Platform

Somerset Wealth Strategies serves as the operational and strategic backbone behind AnnuityFYI, and it works in concert with Somerset Securities, Inc. and Somerset Wealth Management, LLC to support clients across the full spectrum of retirement and wealth planning needs.

Broadly speaking:

- Somerset Securities, Inc. focuses on securities and alternative investments, operating as the group’s SEC-registered broker-dealer and member of FINRA/SIPC. It provides the infrastructure for brokerage, mutual funds, variable products, and other securities-based solutions.

- Somerset Wealth Management, LLC provides fee-based, fiduciary advisory services, delivering AUM-based wealth management and institutional-style portfolio construction.

- Somerset Wealth Strategies, LLC emphasizes fixed and fixed indexed annuities, life insurance, long-term care, and other non-securities-based retirement strategies.

Somerset is responsible for reviewing, organizing, and presenting financial content in a way that:

- Follows industry best practices

- Aligns with current regulations

- Meets the real-world needs of consumers seeking unbiased guidance

A key part of Somerset’s role is managing relationships with the writers, researchers, and financial experts who contribute to AnnuityFYI. By overseeing quality control and editorial integrity, Somerset ensures that all content is:

- Factual and well-researched

- Compliant with relevant standards

- Relevant to current market conditions

Somerset also shapes the overall educational tone of the platform—making complex topics easier to understand without sacrificing depth or accuracy. Operationally, the company handles:

- Content development

- Editorial and compliance review

- Ongoing updates and organization

- Overall platform management

All of this supports a consistent, trustworthy experience for users who are navigating the complexities of retirement planning and annuity decisions.

Empowering Individuals to Make Smart Financial Choices

AnnuityFYI and the Somerset companies share a central mission: give individuals the knowledge and confidence to make thoughtful financial decisions.

They tackle the confusion and complexity often associated with annuities—an environment that can otherwise be filled with jargon, aggressive sales tactics, and conflicting interests. Instead of pushing products, the focus is on clear, practical guidance so that users can plan for retirement independently and responsibly.

At the heart of this mission is transparency. Information is presented in plain, understandable language, free from hidden agendas or promotional pressure. Users receive realistic assessments of each option, including both advantages and potential limitations.

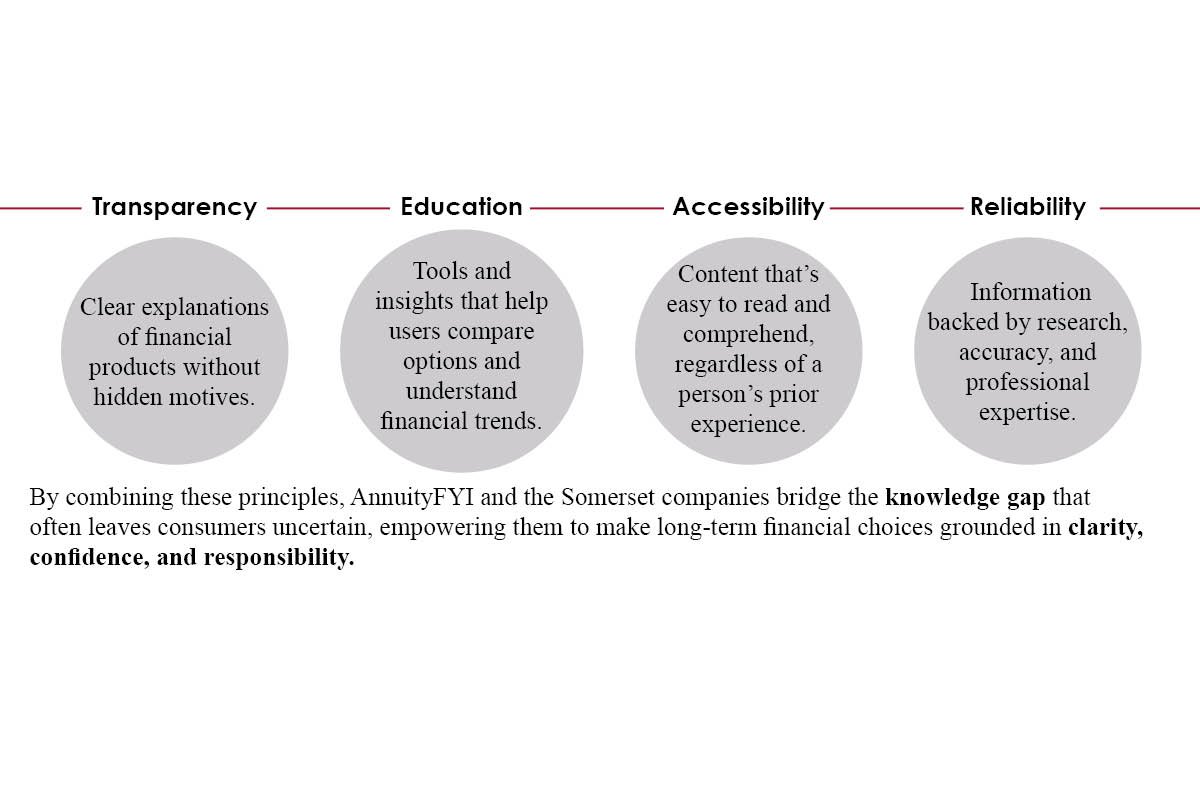

Their approach rests on four key principles:

- Transparency – Clear explanations of financial products without hidden motives.

- Education – Tools and insights that help users compare options and understand financial trends.

- Accessibility – Content that’s easy to read and comprehend, regardless of a person’s prior experience.

- Reliability – Information backed by research, accuracy, and professional expertise.

By combining these principles, AnnuityFYI and the Somerset companies bridge the knowledge gap that often leaves consumers uncertain, empowering them to make long-term financial choices grounded in clarity, confidence, and responsibility.

Extending the Mission: Conquering Retirement with AnnuityFYIPodcast

To reach people in an even more accessible and personal way, Thomas Hamlin and his team created the Conquering Retirement with AnnuityFYI podcast—a natural extension of their “educate first” philosophy.

Hosted by Thomas Hamlin and featuring members of the Somerset team and invited experts, the show is designed as a guide to navigating retirement with clarity, confidence, and control. In each episode, they answer real-world questions and discuss topics such as:

- Annuities and retirement income strategies

- Risk tolerance and portfolio balance as retirement approaches

- The realities of the “4% rule” and making money last

- Cognitive decline, aging, and protecting both finances and family

- Medicare, insurance audits, long-term care, and health-related costs

- Common retirement planning mistakes and how to avoid them

Episodes blend practical education with real conversation—often featuring Thomas Hamlin alongside colleagues and subject-matter experts—so listeners can hear how experienced professionals think through the same issues many retirees are facing.

The podcast format allows the team to:

- Address timely concerns and questions from listeners

- Dive deeper into complex topics that deserve more than a short article

- Give people another no-pressure way to learn—whether at home, on a walk, or during a commute

Together, the AnnuityFYI website, Somerset’s advisory and brokerage work, and the Conquering Retirement with AnnuityFYI podcast create a unified ecosystem: written content for deep reading, personal conversations for tailored guidance, and audio episodes for ongoing learning and encouragement.

Client Testimonials

1. Debbie K.

“EXCELLENT team that did and continue to do the research in scouring the annuity marketplace to meet my needs! Great customer service and attention to detail. I did not get the expected ‘pushy sales approach’ and they continue to provide ongoing service and always answer my requests in a timely manner.”

2. Aaron K., Multi-Generation Family Client

“Thomas Hamlin and his team are absolutely the best in the business! My grandparents found Tom after hearing about him on the radio 30 years ago. Since then he has helped three generations of our family to safely invest our money and grow our accounts far exceeding all of our expectations. With Tom’s advice and guidance my grandparents were able to retire at a young age and live extremely comfortably, never having to worry about the stress of finances.

I personally started working with Tom 10 years ago. Since then my accounts are up over 200%. One account in particular started with $80K in 2021 and in just four years is already at $250K! He is a true industry expert and a wealth of knowledge. He has a genuine care for each of his clients and his team is incredibly helpful and responsive. My family and I would not be where we are today if it were not for Tom and we are eternally grateful for his guidance over the many years, and many more to come!”

3. David B.

“Extremely helpful and efficient. Understood my immediate and long-term needs. Worked very quickly to meet them. Will definitely be using them again and again.”

These kinds of experiences reflect the core promise Thomas Hamlin built into Somerset, AnnuityFYI, and the podcast: educate first, serve the client’s best interest, and earn trust over time—not through pressure.

Education Comes First

Many annuity websites are designed primarily to sell products and funnel users toward specific options. AnnuityFYI and the Somerset companies take a very different path: they lead with education, not sales.

The goal is to help people truly understand their choices, not just react to a product pitch. The platform—and now the podcast—provides clear information without pressure, so users can move at their own pace and make thoughtful, confident decisions.

Education is tailored to users with a wide range of financial backgrounds. Complex concepts are broken down into clear, understandable terms without leaving out important details, allowing beginners to get up to speed while still offering deeper insight for more experienced readers.

With easy navigation, a clear writing style, and well-organized content categories, users can quickly find what they need—whether they are:

- Exploring income options

- Researching long-term products

- Comparing different types of annuities

Their approach is different because it:

- Values clarity over persuasion – Information is presented in a straightforward and objective way.

- Focuses on decision support – Rather than “selling,” the platform and podcast equip users with tools to make their own decisions.

- Encourages self-evaluation – Individuals are guided to consider their goals, lifestyle, and risk tolerance.

- Builds long-term trust – The emphasis is on credibility and reliability, not short-term transactions.

Instead of overwhelming users with industry jargon, AnnuityFYI and Somerset foster an environment where questions are welcome, and knowledge becomes the foundation for action.

A Team with Decades of Experience

Behind AnnuityFYI, the Somerset companies, and the Conquering Retirement with AnnuityFYI podcast is a team of financial writers, researchers, advisors, and subject-matter experts with decades of combined experience in annuities and retirement planning.

They bring together expertise in:

- Finance and investment concepts

- Retirement income and annuity strategies

- Content creation and consumer education

- Compliance and regulatory standards

Because they understand annuities and retirement strategies in depth, the team can anticipate the questions people are likely to have and then answer them in straightforward, everyday language—whether in an article, a one-on-one conversation, or a podcast episode.

This collaboration ensures that:

- Complex topics are made as clear as possible

- The information remains accurate, consistent, and genuinely useful

- People at every stage of retirement planning—from early thinking to final decisions—can find value in the content

Commitment to Accurate, Relevant, and Timely Information

Somerset maintains content quality through a structured review and oversight process. Every piece of information published on AnnuityFYI or discussed in educational materials is carefully evaluated to ensure it:

- Meets industry regulations

- Reflects current market conditions

- Follows sound financial principles

Each article goes through thorough research, editorial refinement, and compliance checks before being shared with readers.

Writers and contributors follow consistent editorial standards, use clear definitions, rely on verified sources, and provide transparent explanations. Outdated or unclear content is reviewed and either updated, revised, or expanded—so users always have access to the most relevant and reliable information available.

Somerset also actively monitors developments in the financial industry, including:

- Market trends and product innovations

- Regulatory changes

- Shifts in consumer behavior and needs

As annuity products evolve or new features are introduced, content is refreshed or newly created to reflect those changes—and podcast episodes can address these developments in a timely, conversational format.

This commitment ensures that AnnuityFYI remains a trusted, up-to-date resource for anyone seeking guidance on annuities and retirement planning.

Long-Term Vision

Somerset’s long-term vision is to continue building a dependable, easy-to-use ecosystem where people can learn about retirement planning without feeling confused, misled, or pressured.

Looking ahead, the organization plans to:

- Expand its educational resources across web, audio, and other formats

- Continually improve the quality and clarity of content

- Make complex financial topics even easier to understand and compare

Beyond tools, articles, and episodes, the broader goal is to strengthen consumer confidence, improve financial awareness, and create a space where independent learning becomes a natural part of responsible retirement planning.

With a sustained focus on education, clarity, and genuine support, Somerset, AnnuityFYI, and the Conquering Retirement with AnnuityFYI podcast aim to help more people take control of their financial well-being and move toward retirement with a greater sense of security and peace of mind.

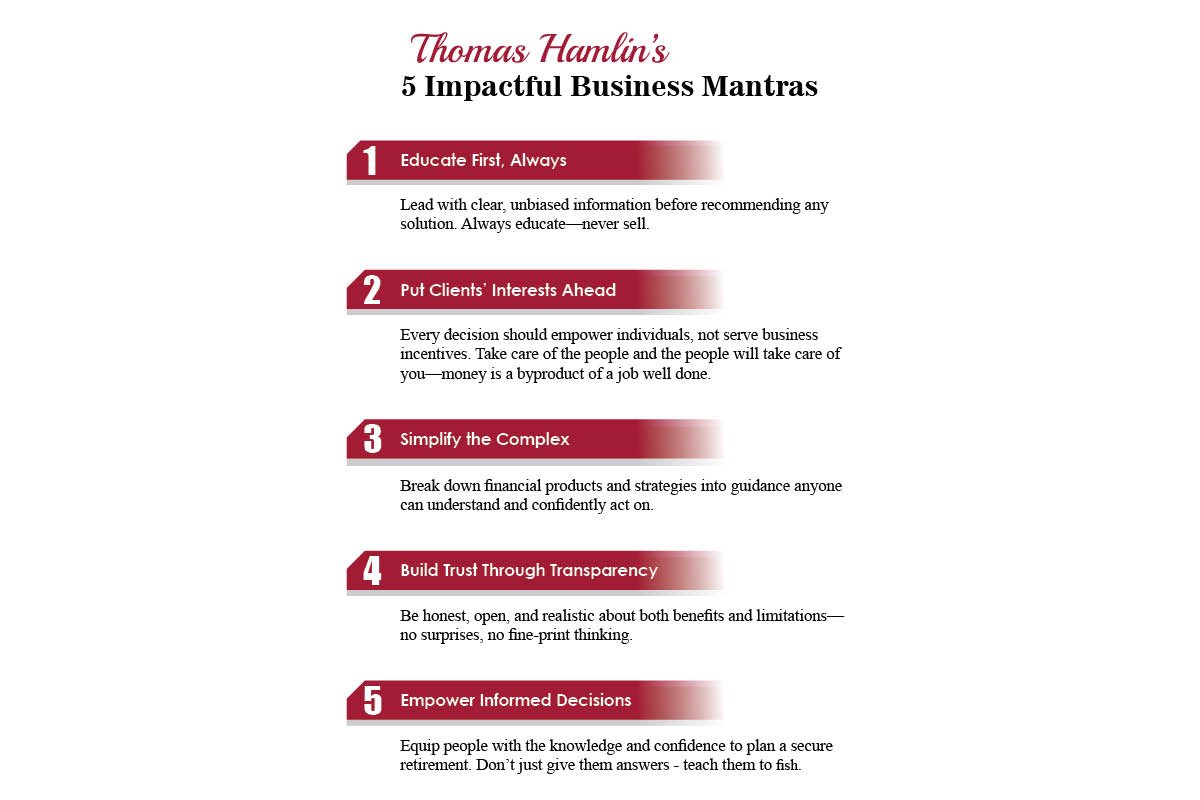

Thomas Hamlin’s 5 Impactful Business Mantras

- Educate First, Always – Lead with clear, unbiased information before recommending any solution. Always educate—never sell.

- Put Clients’ Interests Ahead – Every decision should empower individuals, not serve business incentives. Take care of the people and the people will take care of you—money is a byproduct of a job well done.

- Simplify the Complex – Break down financial products and strategies into guidance anyone can understand and confidently act on.

- Build Trust Through Transparency – Be honest, open, and realistic about both benefits and limitations—no surprises, no fine-print thinking.

- Empower Informed Decisions – Equip people with the knowledge and confidence to plan a secure retirement. Don’t just give them answers – teach them to fish.