Loans can be a great way to finance various expenses, including homes, cars, education, and businesses. However, not all loans are created equal, and choosing the wrong type of loan can end up costing you more money and stress in the long run. Whether you’re contemplating applying for short-term loans, auto loans, or personal loans and Understanding the Various Types of Loans,

This article will help you in Understanding the Various Types of Loans and help you select the best fit for your needs;

1. Secured Loans

Secured loans are backed by collateral, such as a house, car, or another valuable asset. Because the lender has collateral to fall back on if you default on the loan, secured loans typically come with lower interest rates than unsecured loans. However, if you do default, you risk losing the asset you put up as collateral.

Some examples of secured loans include:

- Mortgages: Loans used to buy a home, where the home is used as collateral.

- Auto loans: Loans used to buy a car, where the car is used as collateral.

- Home equity loans and lines of credit: Loans that allow you to borrow against the equity you have in your home.

2. Unsecured Loans

Unsecured loans, on the other hand, are not backed by collateral. Because the lender has no guarantee that you will repay the loan, unsecured loans typically come with higher interest rates than secured loans. However, they are less risky in terms of losing an asset.

Some examples of unsecured loans include:

- Personal loans: Loans that can be used for a variety of purposes, such as home improvements or debt consolidation.

- Credit cards: A revolving line of credit that can be used for purchases and cash advances.

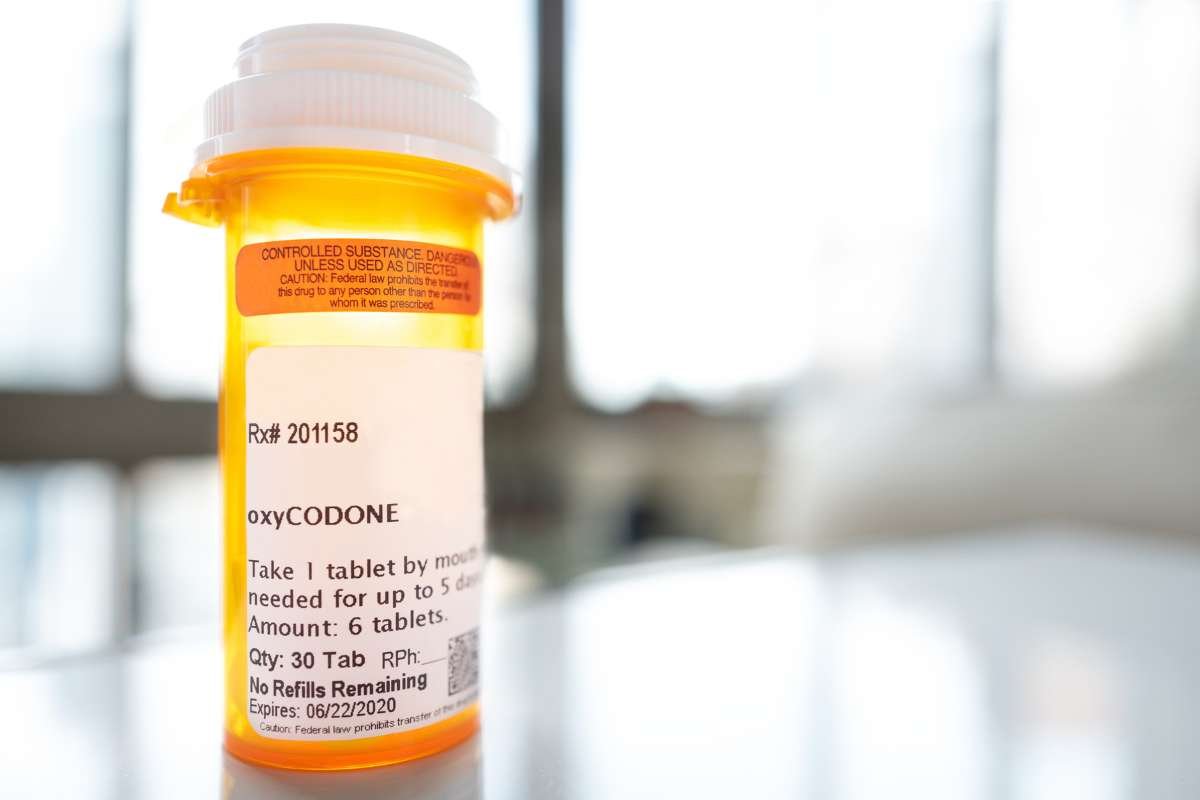

3. Short-term loans

Short-term loans are a type of loan that typically must be repaid within a year or less. They are often used by individuals and small businesses who need cash quickly for unexpected expenses or to cover temporary cash flow shortages. Short-term loans may have higher interest rates than longer-term loans, but they can be a useful tool for those who need immediate access to cash. Some common types of short-term loans include:

- payday loans

- cash advances

- lines of credit

As with any type of loan, it’s important to carefully consider the terms and your ability to repay before taking on a short-term loan.

4. Personal loans

Personal loans are a type of unsecured loan that can be used for a variety of purposes, such as debt consolidation, home improvements, or unexpected expenses. They are typically repaid over a period of 2-5 years and have fixed interest rates and monthly payments.

Personal loans may have lower interest rates than credit cards and other types of unsecured loans, making them a popular choice for those looking to consolidate high-interest debt. However, personal loans may require good credit or a co-signer to qualify for the best rates and terms. Before taking out a personal loan, it’s important to shop around and compare offers from multiple lenders to ensure you’re getting the best deal for your financial situation.

Choosing the Best Loan for Your Needs

When choosing a loan, it’s important to consider your financial situation, the purpose of the loan, and the terms of the loan. Here are some factors to consider the Understanding the Various Types of Loans:

- Interest rate: Look for a loan with the lowest interest rate possible to save money over the life of the loan.

- Term: Consider the length of the loan and whether you can afford the monthly payments over that period of time.

- Fees: Look for loans with minimal fees or no fees, as fees can add up quickly and make the loan more expensive.

When considering a loan, it’s crucial to assess your financial situation and determine if you can realistically afford the loan payments. This includes taking a look at your income, expenses, and credit history. If you have a stable income and can comfortably afford the loan payments, you may qualify for lower interest rates and better loan terms. However, if you have a history of missed payments or defaults, you may be considered a higher-risk borrower and may have to pay higher interest rates.

It’s important to be realistic about your ability to repay the loan. Taking out a loan with payments that are too high can lead to missed payments, default, and damage to your credit score. Before taking out a loan, make a budget to ensure that you can afford the monthly payments, including interest and fees.