Inject Quick Cash

If you have worked for a big company for most of your career, you know what a frustrating experience that can be. We come into the adult world hoping to make a difference by doing work that matters. In reality, instead of fulfilling our dreams, we find that we are part of a world where the daily routine is monotonous and most of what we do is underappreciated and of little consequence.

Given this reality, it’s no wonder that more and more people are opting to leave the corporate environment behind for the entrepreneurial path. They are excited about being their own boss, creating something that truly matters and charting their own course in life. If you’re about to say good-bye to your corporate job in the hope of starting your own venture, the following are some tips to help out with navigating the early days of financial uncertainty. Following 3 Tips to Inject Quick Cash into Your Business.

1. Leveraging the Equity of Your Home

When you are starting a new entrepreneurial venture, you are going to need to have startup capital and funds for your initial operating expenses. Since you will be forming a new company, it’s unlikely that you’ll be able to find banks that will loan you that money. Instead, you’ll have to leverage the assets you have and see how you can convert some of your holdings into cash to help get your business off the ground.

One of the resources you can turn to at this time is the equity in your home. If your home has increased in value or you’ve paid down a significant portion of the existing loan, you can look to refinance and pull cash out. Alternatively, you might take out a second mortgage or home equity loan that would free up funds to invest.

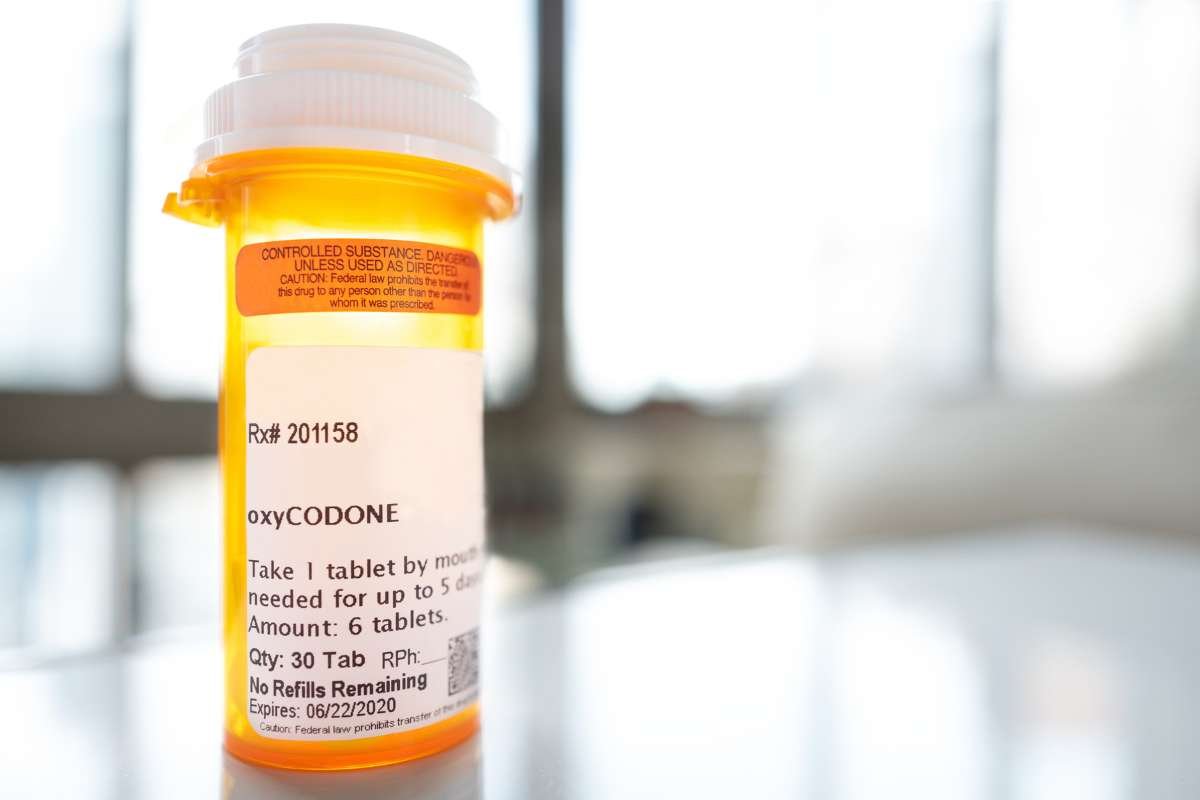

2. Tapping in the Value of Your Life Insurance

In order to fully fund your new business, you’ll want to be sure you have the Inject Quick Cash you need for both your initial investments and for ongoing expenses you’ll incur in the first months. Having that money available will help assure that your new company is successful and has the funding to draw on while you are waiting for the first sales and signed customer contracts to come in.

One creative way to make sure you have enough money available is to tap into the cash surrender value of your life insurance policy. This money, which can be available if you cancel your policy, differs depending upon your policy terms and conditions. If you are considering this option, you can read a helpful guide that will take you through the ins and outs of cash surrender value and cancelling your policy.

3. Take Advantage of Crowdfunding

If your company will be producing a product that might be a hit with consumers, another option you might consider is to set up a crowdfunding campaign. Several leading websites will allow you to showcase your product idea in the hope of creating a viral buzz, even before the item goes into production. This is a great way to present a professional first impression of both your product and your business.

If you build a working prototype, you’ll be able to create powerful videos that will show the product in action and get consumers excited about your new offering. You can also use social media ads to target your preferred audience demographic and direct people to your site. From there, with a carefully crafted marketing campaign, you can get them excited to be part of your initial offering. These sites will also let them pre-order and pay for the product, and send referrals to their friends too.