So you’re interested in the Czech Republic? You’re confused about moving to the Czech Republic. Would you work or start a business in the Czech Republic?

Almost any business in Europe and beyond is associated with the need to study the market. What do you know about how to open a business in Prague, or how developed the hotel Business in the Czech Republic, which Czech companies are your direct competitors, what taxes are in the Czech Republic or how strong the Czech economy is?

In the Czech Republic, several currencies are used for settlements: the Czech crown, the euro and sometimes the dollar. To succeed in the Business in the Czech Republic, you must know the current exchange rates. Remember that Prague’s euro and Czech koruna exchange rates are the same as those in other Czech cities.

Most immigrants and locals want to open company in Czech Republic because it’s easy.

Let’s Read below all about Business in the Czech Republic;

Business in the Czech Republic: what to know

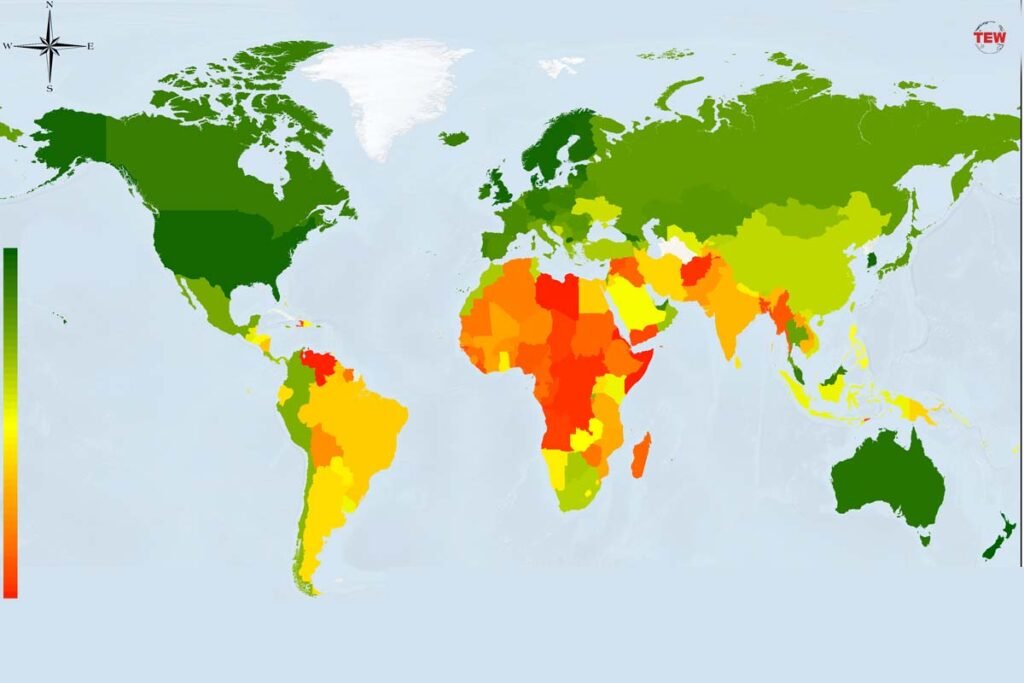

The ease of doing business ranks the Czech Republic 27th out of 190 countries according to the World Bank Group. According to the data, the Czech Republic is the easiest country to perform foreign commerce, set up a business, register property, and acquire a bank loan. This comes as no surprise, given the ease and pleasantness with which business may be conducted in the Czech Republic.

Thus, many foreigners establish small, medium, and big enterprises in the Czech Republic. The Czech Ministry of Industry and Trade estimates that 32,230 out of 330,080 active individual entrepreneurs in the Czech Republic are foreign nationals. The majority of these foreign nationals are from Ukraine (9,918), Vietnam (4,228), Russia (17,778), Kazakhstan (343), and other countries. Most individual foreign entrepreneurs are concentrated in the capital of the Czech Republic – Prague, but in recent years, a business owned by foreigners has begun to go beyond the capital.

Although the Czech Republic is a popular destination for foreign businesspeople, it maintains its own distinct approach to doing business. When launching any kind of commercial firm, you have to take into account the specifics of the Czech market, which are highly specialized and conservative. Understanding tax and administrative requirements for launching and maintaining a Czech firm is the largest barrier.

In order to accurately identify the pricing strategy of the business, you must first get familiarity with the local mindset, which is what ultimately dictates the nature of the demand for goods and services. The inability to communicate effectively in Czech is a major roadblock to business success.

Foreign entrepreneurs in the Czech Republic praise the startup process and the government’s minimal bureaucracy. For instance, a sole proprietorship (ivnostenské oprávnn) may be established in only five working days for a total of 1000 CZK, a completed application, and the applicant’s passport (and perhaps a certificate of no criminal record).

If you need help starting a business in the Czech Republic or in obtaining a crypto license Estonia, you can feel free to contact Fintech Harbor Consulting.

A single Czech Koruna (CZK) in authorized capital is all that’s needed to launch a limited liability corporation. The Czech state’s 50,000-to-multimillion-kroon subsidies for small and medium-sized firms are also encouraging. They can be received not only by Czech citizens, but also by foreign entrepreneurs who have opened an individual entrepreneur or legal entity in the Czech Republic. The applicant awards funding based on the business plan’s suggested structure.