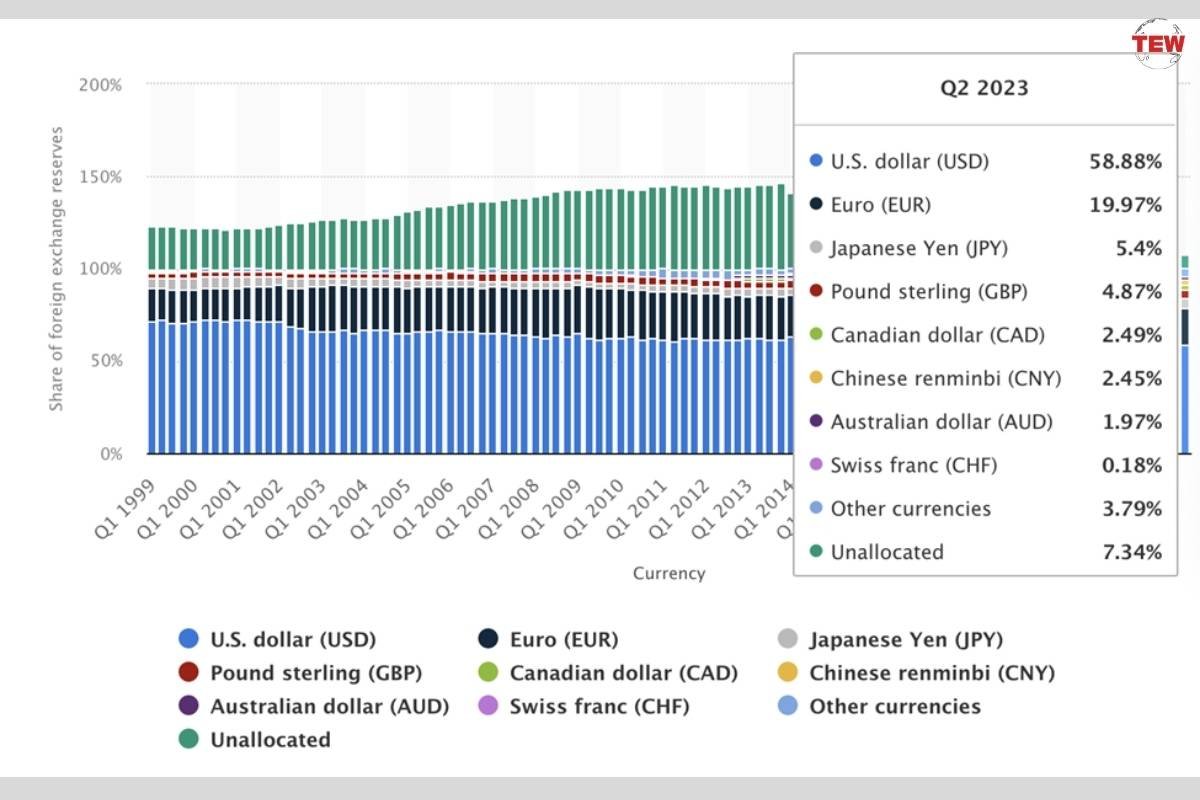

(Source: Statista Share of Currencies Held in Global Foreign Exchange Reserves)

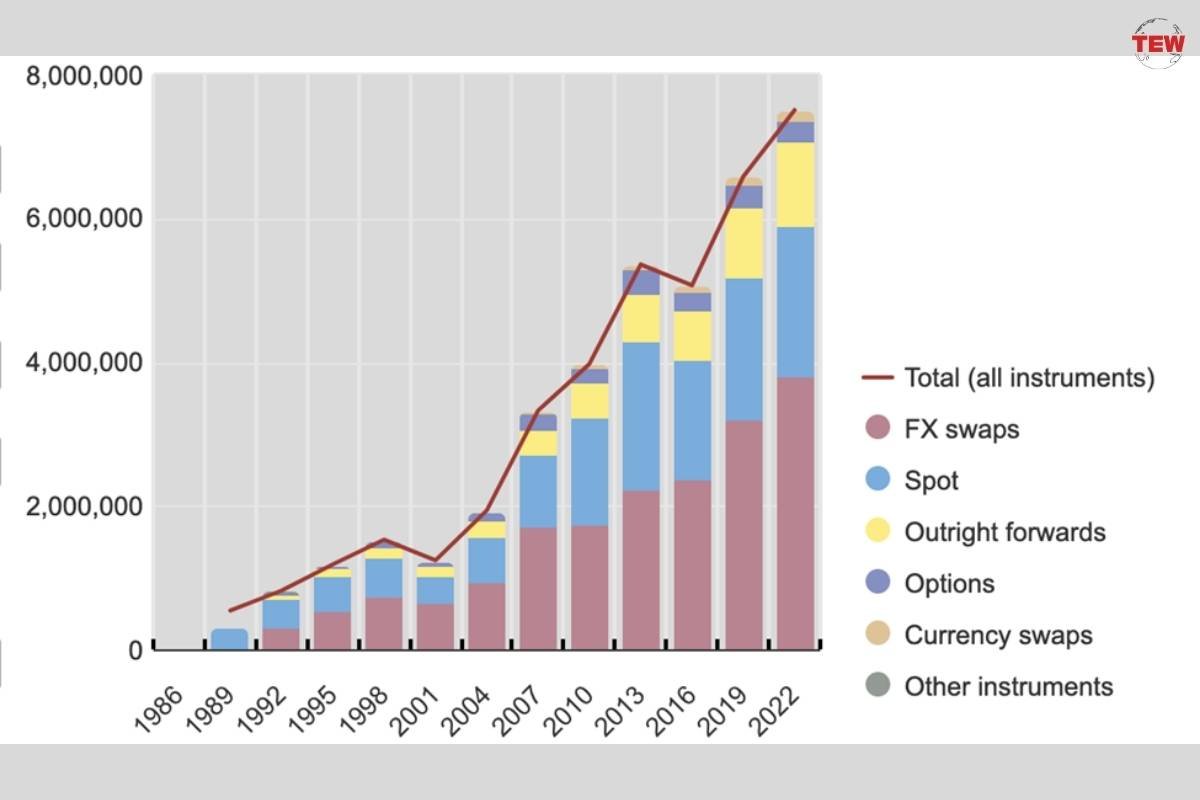

In the intricate web of global finance, the foreign exchange (Forex) market is a colossal entity, influencing nations, businesses, and individual investors. As this market navigates through a labyrinth of economic shifts and policy changes, the need for powerful tools to keep pace becomes paramount. Among these tools, the best forex app emerges as a powerful tool for traders, offering real-time insights and a gateway to smart trading decisions in an ever-fluctuating market. At its peak in 2022, the forex market topped $7.5 trillion in daily trades.

The Dominance of the U.S. Dollar

The U.S. dollar is at the heart of the forex market, a currency that has long held the reins of global finance. Accounting for most foreign exchange reserves, the dollar’s supremacy is a tale of economic might and strategic policymaking. However, this narrative is not without its twists. The year 2020 marked a poignant chapter where the dollar, though still formidable, saw its dominance slightly wane, conceding ground to the likes of the Japanese yen and the euro. This shift, partly rooted in the aftermath of the Eurozone crisis, is a reminder of the market’s dynamic nature.

Source: BIS Triennial Central Bank Survey OTC Derivatives

Foreign Exchange Reserves and Their Importance

Understanding the forex market requires understanding why nations stockpile vast foreign exchange reserves. In a world where trade transcends borders, these reserves serve as a crucial buffer, facilitating smooth international transactions. With its perceived stability and universal acceptance, the U.S. dollar has been the cornerstone of these reserves. Post World War II, the dollar’s ascent to this pivotal role under the Bretton Woods Agreement underscored its significance in maintaining global economic balance.

| Year | U.S. Dollar Trends | Influencing Factors |

| 2010s | Regained strength, economic recovery post-Great Recession | Economic growth, recovery from recession |

| 2015 | Strengthened against EUR and JPY, weakened against GBP and CAD | Federal Reserve interest rate hikes |

| 2016 | Weakened against EUR, GBP, JPY, and CAD | Economic factors |

| 2017 | Strengthened against EUR and JPY | Economic factors |

| 2018 | Strengthened against GBP | Economic factors |

| 2019 | Weakened against EUR, GBP, and JPY | Economic factors |

| 2020 | Weakened against major currencies due to pandemic | COVID-19 pandemic |

| 2022 | Strong against EUR, GBP, JPY, and CAD; aggressive interest rate hikes | Federal Reserve’s aggressive interest rate hikes |

| Historical Revaluations | Revalued in 1934 (Gold Standard abandonment), and other historical revaluations | Various factors, including wars, natural disasters, trade wars, and economic policies |

This table provides a concise overview of the U.S. dollar’s exchange rate trends over the years, highlighting key moments and factors that influenced its value against other major currencies.

China’s Growing Influence

(Source: The Enterprise World: China GDP)

As the forex market’s narrative unfolds, new players emerge, reshaping its contours. A prime example is China, whose currency, the renminbi, has gained recognition from the International Monetary Fund (IMF) as part of its Special Drawing Rights (SDR) basket. This inclusion is not just a nod to the renminbi’s growing clout but also a testament to China’s burgeoning economic prowess, backed by substantial foreign exchange reserves.

Recent Forex Trading Trends

Like any financial market, the forex market is subject to the ebb and flow of economic currents. Recent data from Euronext FX paints a picture of this volatility. The first quarter of 2023 witnessed a decline in forex trading volumes, followed by a significant uptick later. This fluctuation mirrors the broader market’s pulse, responding to global economic trends and investor sentiment.

The Role of Forex Trading Apps

Forex trading apps have become indispensable resource for traders in this complex and fast-paced market. They offer convenience and a comprehensive suite of tools for analysis, decision-making, and staying abreast of market trends. The right app can transform a daunting task into an intuitive and insightful experience, making it a crucial ally for anyone venturing into the Forex arena.

Conclusion

As the forex market evolves, staying informed and adaptable is key. For traders, this means choosing tools, including forex robot trader, that offer depth, accuracy, and real-time data. A dynamic forex trading app, thoughtfully selected, can mean the difference between navigating the market with confidence or being lost in its complexity. In this dynamic financial landscape, the right app is a tool and a gateway to possibilities.