Becoming a skilled options trader takes time and practice. But what are the best ways to hone your Options Trader skills? We’ll discuss some essential tips for becoming a more successful options trader and provide some helpful resources to get you started. So, whether you’re just starting or looking to improve your skills, read on for advice to help you become a more successful options trader.

What is options trading, and why should you learn it?

Options trading is an investment that allows you to reap the benefits of stock ownership without actually owning the shares themselves. When you buy options, you’re essentially betting on the future direction of a stock’s price. If you think the stock will go up, you buy a call option, and if you think it will go down, you buy a put option.

There are two main reasons you might want to learn how to trade options. First, options provide leveraged returns, meaning your potential profits (or losses) are magnified compared to simply buying and selling stocks. Second, options can help protect your portfolio from downside risk by hedging against losses in your underlying stocks.

How to get started with options trading

If you’re new to options trading, the best place to start is with a demo account. A demo account is an account that allows you to trade with ‘play money’ instead of real money. It is a great way to learn the ropes and get comfortable with the process without putting your hard-earned cash at risk.

You’ll need to open a brokerage account once you’re ready to move on from the demo account. You can do this through a traditional broker like Charles Schwab, Saxo or Fidelity or an online broker like Robinhood or TD Ameritrade. Once you’ve opened your account, you’ll need to fund it with enough money to cover your trades.

Now that you have a brokerage account, you’re ready to start trading. But before you do, it’s essential to understand the different types of options and how they work. You should also be familiar with how to open trade.

The two main types of options are calls and puts

A call option gives you the right to buy a stock at a specific price (the strike price) on or before a specific date (the expiration date). If the stock price is above the strike price when the expiration date arrives, you can exercise your option and buy the shares at the strike price. If the stock price is below the strike price, you let the option expire worthlessly and don’t buy the shares.

A put option gives you the right to sell a stock at a specific price (the strike price) on or before a specific date (the expiration date). If the stock price is below the strike price when the expiration date arrives, you can exercise your option and sell the shares at the strike price. If the stock price exceeds the strike price, you let the option expire worthlessly and don’t sell the shares.

Of course, there’s more to it than that. Options come in different variants, like American-style or European options, with different expiration dates and strike prices. But these are the basics of how calls and puts work.

How to become a more skilled options trader

Now that you know the basics of options trading, it’s time to start honing your Options Trader skills. Here are some tips to help you become a more successful options trader:

Do your homework

Before you trade, it’s essential to do your research and understand the underlying stock. What’s the company’s history? How has its share price performed in the past? What is the current market sentiment towards the stock? Answering these questions can help you make more informed trading decisions.

Have a strategy

To become a more skilled options trader have a strategy is very important. It’s essential to have a plan before you enter any trade. What is your goal? Are you looking to make a quick profit, or are you taking a longer-term view? Once you know your goal, you can develop a strategy to help you achieve it. There are many different options strategies out there, so do research and find one that fits your goals and risk tolerance.

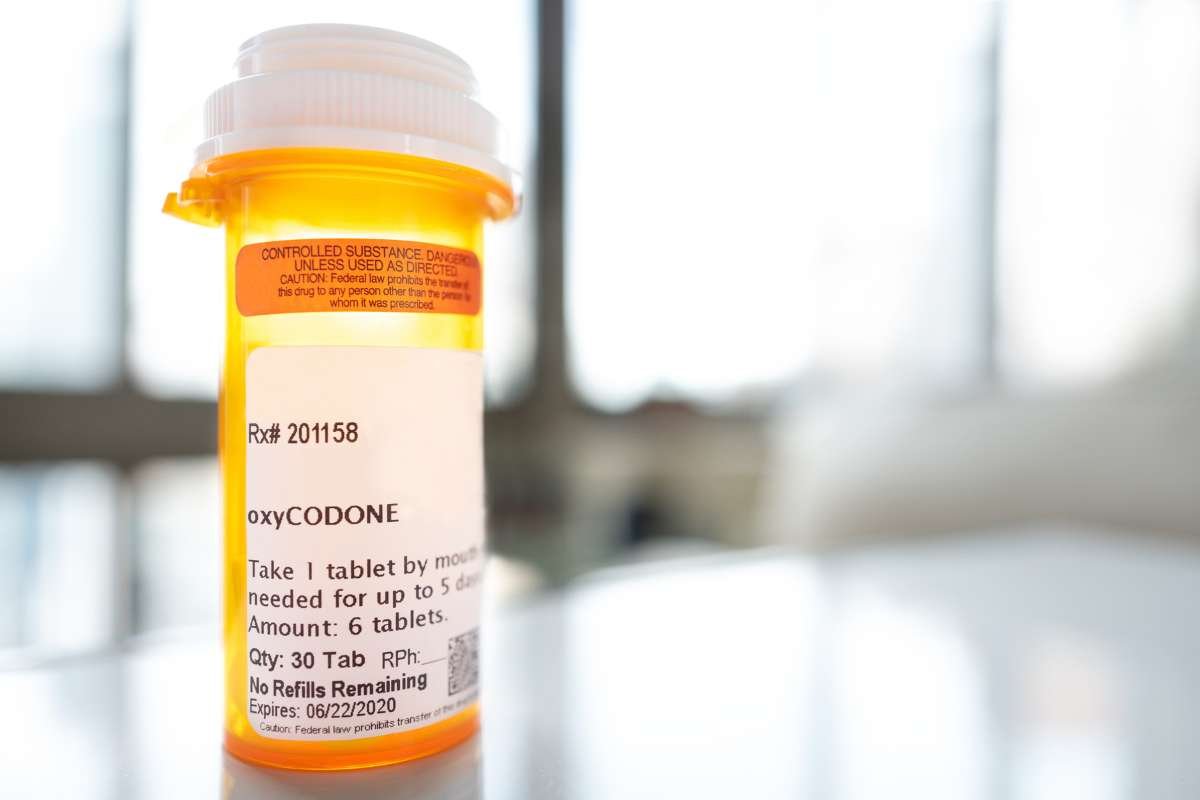

Manage your risk

Options trading involves a certain amount of risk. But there are ways to minimise that risk. One way is to use stop-loss orders, which automatically close out your position if it reaches a specific price. Another way is to limit your position size, so you’re only risking a small portion of your capital on each trade.