Are you tired of waiting weeks or even months for your customers to pay their invoices? Do you work in an industry often facing cash flow challenges due to extended payment periods? If so, invoice factoring can be the solution you need to improve your cash flow and keep your business running smoothly.

In the following, you can learn how invoice factoring benefits various industries;

1. Manufacturing Industry

Manufacturing companies can avoid cash flow problems with the help of invoice factoring, which gives them immediate cash for their overdue bills. They may invest in expansion possibilities and cover operating costs without worrying about when their money will come in.

For example, a woodworking business has an unpaid invoice for USD$5,000 from a large client due in 60 days. The business needs to pay its employees and purchase raw materials for their upcoming orders, but it cannot do so without payment from this client.

By using invoice factoring, they sell the unpaid invoice to a factoring company for USD$4,750, minus the factoring fee. This allows the woodworking business to payment receipt template immediate funding and pay for their expenses without worrying about the timing of their client’s payment.

2. Transportation Industry

Transportation companies face cash flow issues due to the extended payment periods they must wait for, leaving them with little funds to pay for expenses. The freight factoring guide from REV Capital helps in this regard. Companies can sell unpaid invoices to receive immediate cash, allowing them to cover their operating costs and pursue new opportunities.

For example, a small trucking company can sell an outstanding invoice of $3,000 to a factoring company for $2,500 minus the factoring fee, receiving immediate funding and enabling them to avoid payment delays.

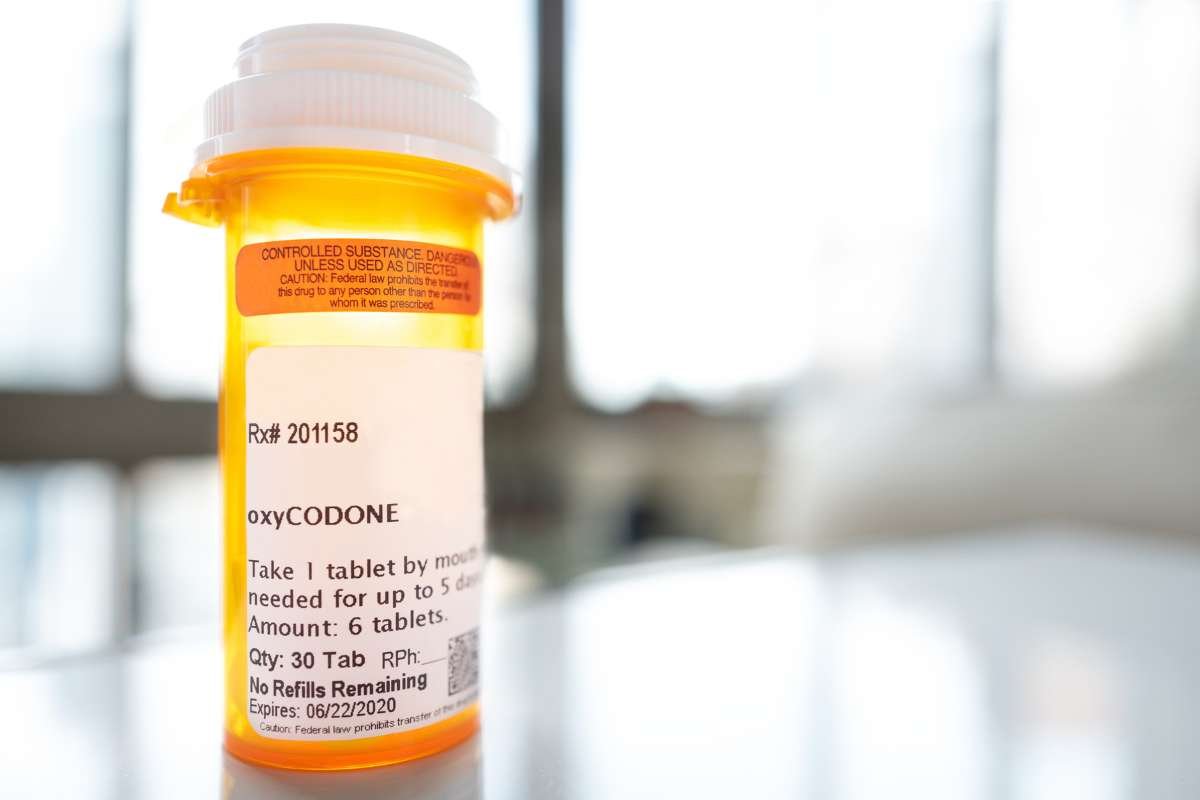

3. Healthcare Industry

The healthcare industry also benefits from invoice factoring in the following ways:

- Provides immediate cash for unpaid invoices

- Allows healthcare providers to cover operating expenses

- Enables providers to invest in new equipment or technology

- Overcomes cash flow challenges from extended payment periods

One interesting fact about the healthcare industry and invoice factoring is that this financial strategy can help small medical practices and clinics compete with larger healthcare organizations.

Invoice factoring allows them to cover operating expenses and invest in new equipment or technology. This way, they can offer better services and compete with larger healthcare organizations with more resources. Invoice factoring is a valuable tool that can help level the playing field for healthcare providers and improve the quality of care for patients.

4. Construction Industry

Invoice factoring can help construction companies in a number of ways. They can take on new projects without waiting on payments, pay for labor, materials, and expenses, and overcome cash flow challenges from extended payment periods.

For example, a construction company was hired to build a new office building for a large corporate client. The project was completed on time and within budget, but the client’s accounting department experienced a delay in processing the invoice. Weeks went by without payment, and the construction company faced cash flow challenges as they had to pay for the project’s labor, materials, and expenses out of their own pocket.

To overcome their cash flow challenges, the construction company used invoice factoring. They sold the unpaid invoice to a factoring company to receive immediate cash, which allowed them to pay their expenses and take on new projects. The factoring company took on the risk of non-payment and handled collections, allowing the construction company to focus on its business operations and continue to grow business.

Other Benefits Of Invoice Factoring For Businesses

In a nutshell, this is how invoice factoring works and how it can benefit businesses in general:

- Invoice factoring is an excellent way for businesses to improve their cash flow by selling their unpaid invoices to a third-party company for immediate cash.

- It’s not a loan, which means businesses don’t have to worry about incurring debt or interest rates.

- Factoring companies can handle the collections process for businesses, saving them time and resources.

- Invoice factoring can help businesses improve their credit ratings by providing a steady cash flow, making it easier to obtain financing from banks and other financial institutions.

- The factoring fee is usually a small percentage of the invoice value, a small price for immediate cash flow.

Conclusion

Whether you work in the transportation, manufacturing, healthcare, construction, or any other industry that faces cash flow challenges, invoice factoring can help keep your business running smoothly. It also lets you focus on growing your business and investing in new opportunities. So why wait weeks or months for your customers to pay their invoices? Consider invoice factoring as a smart financial strategy for your business.