(Source-TechDemand)

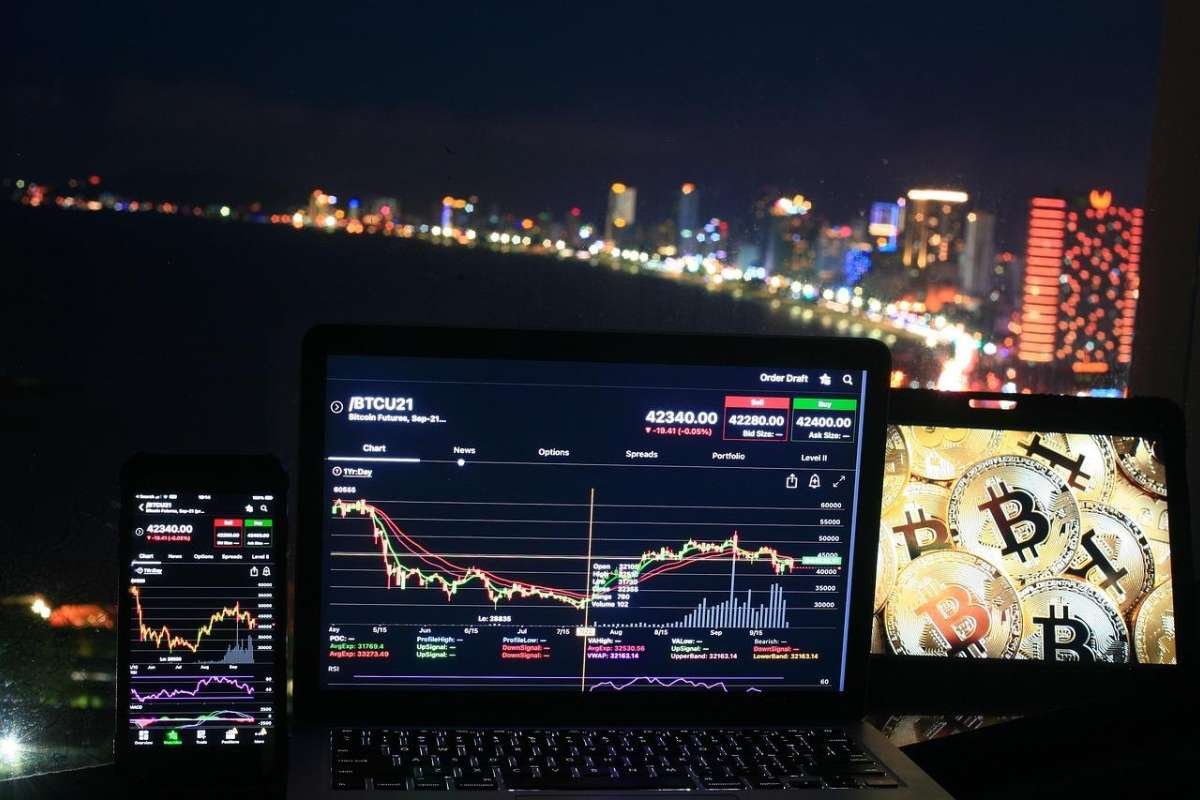

Cryptocurrencies have spurred innovation in finance, compelling traditional central banks to adapt. This article explores how central banks shape the future of digital currencies and their wider implications in the ever-evolving financial landscape. Bitcoineer is a user-friendly and comprehensive Bitcoin and cryptocurrency trading and charting platform, crafted to provide a smooth and enjoyable trading experience for investors and traders of all levels.

The Crypto Revolution

The Genesis of Digital Currencies

The meteoric rise of cryptocurrencies, beginning with Bitcoin in 2009, has disrupted the financial sector on a global scale. These digital assets leverage blockchain technology to provide secure and decentralized alternatives to traditional currencies. With the soaring popularity of digital currencies, there has been a growing interest among central banks in issuing their digital currencies, often referred to as central bank digital currencies (CBDCs).

Central Banks Enter the Fray

The Birth of CBDCs

Central banks, which have traditionally controlled the money supply, have recognized the need to adapt to this digital revolution. As we look at the broader financial landscape, several key developments are taking place.

1. Rethinking Monetary Policy

The advent of cryptocurrencies has forced central banks to reevaluate their monetary policies. The decentralized nature of digital currencies challenges the conventional tools central banks use to manage inflation and control the money supply. As a result, they have started exploring CBDCs as a way to regain control and adapt their monetary policies to the digital age.

2. Enhancing Financial Inclusion

Another crucial aspect is the potential for CBDCs to promote financial inclusion. Unlike cryptocurrencies, which can be complex for the uninitiated, CBDCs can be designed with user-friendly interfaces and regulatory protections. This could open up financial services to individuals who are currently excluded from the traditional banking system.

3. Tackling Illicit Activities

The anonymous nature of cryptocurrencies has raised concerns about their use in illicit activities, such as money laundering and tax evasion. Central banks are keen on developing CBDCs with built-in controls to address these issues, creating a more transparent financial ecosystem.

The CBDC Race

Global Initiatives

As the world races to adapt to the crypto revolution, several countries have taken the lead in developing their CBDCs. China’s Digital Currency Electronic Payment (DCEP) project, for instance, is already in advanced stages of development and testing. The European Central Bank (ECB) has also initiated the exploration of a digital euro, and the Federal Reserve in the United States is studying the potential implementation of a digital dollar.

1. China’s DCEP

(Source-Forkast-News)

China has been at the forefront of CBDC development, with its Digital Currency Electronic Payment (DCEP) initiative. The project has been in the works since 2014, and pilot programs have been conducted in various cities. DCEP aims to reduce the costs of cash circulation, enhance financial inclusion, and provide a digital counterpart to physical currency.

2. The European Central Bank

The ECB is actively researching and analyzing the potential benefits and challenges of a digital euro. The project focuses on ensuring privacy, security, and convenience for users. The ECB aims to provide a digital currency that coexists with cash and meets the diverse needs of European citizens.

3. The U.S. Federal Reserve

While the Federal Reserve has been cautious in its approach to CBDCs, the rapid rise of cryptocurrencies has prompted more in-depth exploration. The U.S. is examining the implications of a digital dollar, considering both the technical and policy aspects.

CBDCs vs. Cryptocurrencies

Key Differences

It’s essential to understand the distinction between CBDCs and cryptocurrencies. While both fall under the category of digital currencies, they have fundamental differences that will shape their future role in the financial landscape.

1. Centralized Control

The primary difference is centralization. CBDCs are issued and controlled by central banks, giving them regulatory authority. Cryptocurrencies, on the other hand, are decentralized and typically operate outside the control of traditional financial institutions.

2. Stability

CBDCs are designed to be stable and are often pegged to the national currency. This provides a sense of security and predictability that can be lacking in the highly volatile world of cryptocurrencies.

3. Privacy and Anonymity

Cryptocurrencies are often praised for their anonymity. CBDCs, in contrast, can be designed with various degrees of anonymity, potentially incorporating anti-money laundering and know-your-customer measures.

The Broader Impact

Beyond Currency

The introduction of CBDCs has implications beyond the realm of money. Here are some of the broader impacts:

1. Blockchain Integration

(Source-Innovecs)

The development of CBDCs has accelerated the adoption of blockchain technology, which underpins most cryptocurrencies. This technology has far-reaching implications across various sectors, including supply chain management, healthcare, and more.

2. Transforming Financial Services

CBDCs can reshape the financial services industry. They have the potential to streamline payment processing, reduce transaction costs, and enable financial innovation through smart contracts and programmable money.

3. Geopolitical Influence

The rise of CBDCs may have geopolitical ramifications. As countries develop their digital currencies, they could gain influence in the global financial landscape, challenging the role of the U.S. dollar as the world’s primary reserve currency.

Conclusion

Central banks are responding by exploring CBDCs to adapt monetary policy, enhance financial inclusion, and combat digital-age illicit activities. This CBDC race carries far-reaching implications for the global financial landscape and the world’s economic power structure, signifying the inevitable digital future of finance led by central banks.