Go Digit General Insurance – To Simplify What’s Complicated

Why does one need a financial advisor? Let’s face it, doing all the finances can sometimes be cumbersome, and more so if you don’t have the proper knowledge. So it is the task of a financial advisor to make these tasks simpler.

Be it traditional or any way of insurance, it just is cumbersome. One has to go through many processes to finally get their hands on it. This becomes even more complicated as most customers lack the understanding of which product is right for them.

A financial advisor will help you here. He will not only be your planning partner but will also educate you. He will help you with investments, tax laws, and other insurance decisions.

If all this is sounding too complicated, you have nothing to worry about, Go Digit is here! The company is here to make insurance easy! With that as their mission, they are reimagining products and redesigning processes, going back to the basics, and building simple and transparent insurance solutions, that matter to people.

The Journey of Making it Simple-

Over the years, insurance got entangled with loads of terms & conditions, some hidden and some that could only be understood by lawyers. This happened because the system was geared towards avoiding frauds more than protecting genuine customers. Result? An industry that people don’t trust, a system that is complicated & jargonized. This is exactly what Digit set out to challenge, to bring back insurance in its real meaning, to ‘Make insurance, simple’.

Go Digit is a new-age general insurance company backed by the Fairfax Group, one of the largest financial services groups in the world. They have raised two rounds of funding amounting to $140 million from Canadian billionaire Prem Watsa’s Fairfax Holdings, which is one of the largest insurance investment companies in the world with operations in over 30 countries. Go Digit is headquartered in Bengaluru.

The Challenge of Making a Difference Go Digit

Reimagining is full of enthusiasm but also has its challenges. Challenges come in the way of finding the right need gap for the customer and designing a solution for that. Also sometimes the acceptance of changes by the regulator and also by the customer pose a challenge.

“Being the 33rd player in the general insurance industry, the challenge was to make a difference. The difference came was to come from the way we reimagine our products and processes.”

In Go Digit’s case, the challenge came in the way they wanted to change their policy documents, to make them simpler for people, wherein they had to question every word of the documents, simplify them and also get them approved by the regulator.

While most of their innovative features in various products gained a lot of traction and appreciation by customers but at times the simplification was unbelievable by people and led to customer queries, for example, Go Digit launched a ‘No activation required’ mobile insurance. While the industry was asking people to download their app and activate the policy; Go Digit thought this will be a much-simplified process but the customers were bewildered that how come a company is not asking for any details and were complaining! To prepare people to get ready for simplicity also, is sometimes a battle with trust and years of complication.

“We were quick to realize that we do not wish to make it a single channel distribution company, we wanted to be omnipresent.”

The inflection point came with this realization coupled with their digital approach which made sure, that whatever channel they were operating in, digitization is simplifying processes and removing redundancies.

Their Services-

Go Digit’s product portfolio has traditional products as the main focus i.e. motor as well as new, innovative products like mobile and home protection that have germinated out of consumer need gaps. Their services are digitally visualized, focusing on removing redundancies from the system; these simplified services have helped them gain the traditional products, which many companies in the world struggle with.

Their refreshingly new way of looking at insurance, this simple way, has earned them the trust of their customers and making them one of the fastest-growing insurance companies in the world.

Go Digit General Insurance has made products keeping in mind themselves, what they can sell to even their moms. For example, the travel delays product starting from just 75 minutes in comparison to the industry’s 6 hours product, which is used rarely by any traveler.

“We made processes, keeping in mind genuine customers and not frauds.”

No submission of claim forms, long processes, and multiple checks, which is why they launched a Smartphone-enabled Self-inspection App for motor claims instead of Manual Inspection. Bringing down inspection time from 24 hours to 7 minutes, thus reducing claims turnaround times (TATs). Same process for mobile leading to industry best TAT for claims.

Rather than the longer terms & conditions, Go Digit sends people a 2-3 pager Summary document that has all the coverages & exclusions, what to do at the time of claim mentioned clearly. And these documents are checked by no other than 15-year old kids for simplicity. When the customer calls for anything our SLA is to answer calls in 20 seconds, no IVR or bots! Go Digit has a happy 1% of market share overall in the general insurance industry, with them becoming the highest gainer in Q2 in terms of market share. The company has also crossed more than a lakh closed claims. This for a 2-year-old company is a feat.

From an overall point, it will be good to see the product portfolio with this financial year’s (Q1 & Q2) premium split.

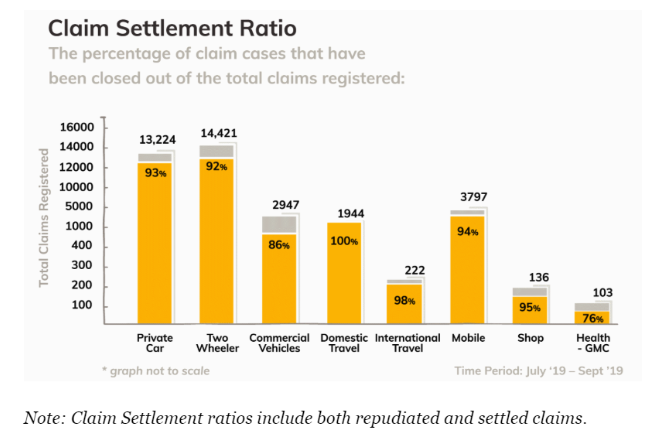

Also, they keep a close eye on their claim settlement numbers as a good claims experience is essential for a happy customer.

“Technology will be our fuel for growth. We are working on newer products and benefits enabled with buying & claiming processes backed by technology. We will try and make as many of our processes into self-service, automated modules so that the speed of the same improves.”

The Team, the Simplifiers-

Kamesh is an insurance veteran, with over 30+ years of experience across markets including APAC, Middle East & North Africa regions. He has worked in both General Insurance and Life Insurance spaces. Before founding Digit, he was the Head of H8- Asset Management & US life insurance Company for Allianz Asset Management.

“If my mind can conceive it, if my heart can believe it, I know I can achieve it.”

The team is a mix of people from the insurance, technology, and e-commerce industry. This diversity sets the tone for the mission of the company i.e. to simplify.

At the outset, people think Go Digit General Insurance has a full start-up environment, but they have a collaborative workspace where exchange of ideas is encouraged, experimentation is appreciated and the vibe is to have fun with work but at the same time, the company functions are process-driven (though in a non-hierarchical way), with a strong focus on performance metrics, not just in the short-term but also in the long-term.

This fine balance of a go-try-it environment and a long-term planning approach is a refreshing mix for their employees.

For recent and latest updates regarding business news, industry trends, etc. Please subscribe Newsletter from “The Enterprise World” at “Subscribe“