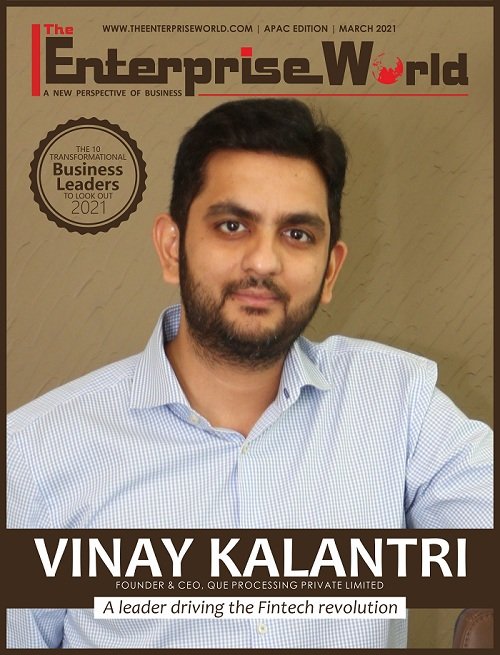

Vinay Kalantri – A Leader Driving the Fintech Revolution – Que Processing Pvt Ltd

Que Processing Pvt. Ltd. – The Most Trustworthy Partner in Fintech

The Fintech sector in India is now at the forefront of economic development, not to mention economic pliability and protection of businesses and people. Over the last few years, the industry has grown significantly, pushing this sector into the group of large Fintech economies globally. It is heartening to note how the industry has grown, and with continuing developments in regulation, it is moving towards another plateau of growth in India.

The healthy investment activity in the sector is a testimony of its performance and resilience. With the industry becoming more organized, transparent, and profitable, it will continue to attract investments from global as well as domestic players. The steps initiated by the government to increase liquidity in the market have also worked well in increasing the confidence of investors.

As a leader, I believe we should “empower” individuals to do their best work by making every day seamless: identify and address needs quietly and with great care before they surface. As we maintain business continuity for the clients we serve, we must also prioritize providing great, whole-person care for our employees.

Why Que Processing Pvt. Ltd.:

Que Processing is a secure open API issuer processing platform, which focuses on powering payment innovators. Que Processing Pvt. Ltd. aims at providing Flexibility to design the program you want, build card programs, and run test transactions which enables you to launch as quickly as you can develop without dependencies on Que Processing Pvt. Ltd. QPS is a platform to help Fintech and Banks to address Credit and manage their Cash flow management.

It provides you a platform where you can manage your rules-based authorizations with real-time data insights that don’t just let you grow but also innovate and continue to roll out new features with ease. Que Processing offers unlimited possibilities on one platform like World-class APIs, a Dedicated developer portal Integrated with a modern core banking platform that provides an instantly accessible private sandbox environment that enables you to have the control in your hands.

Innovation is the calling card of the future.

Cutting through the complexities

To chisel a beautiful statue, you first need to hit the rock, which is what counts! Similarly, when starting a venture, you face challenges, which make up for the successful times of your organization. And tackling them with innovation and efficiency sails your boat! Que Processing has also faced and now also facing and tackling well with the hurdles.

Since Que Processing is a new player in the market and a legacy company in the market already exists. They are trying to break the legacy infrastructure and become a modern Fin-tech platform. The global coronavirus pandemic has far-reaching implications for every aspect of the economy, Fin-tech industry was also feeling some of the consequences of the escalating crisis. Just sitting back relax is not their Thing! The company is striving smart to gain the pace in growth and empowering their client’s businesses to be relevant in the market race after the pandemic.

User first! Keeping this commitment in mind, Que Processing doesn’t build its product based on the technology that is available but is built on the technology as per the end-user needs. Unlike the legacy system, the company’s growth is spurred by constant innovation to meet the end customer’s needs.

Que Processing Pvt. Ltd.’ Diversified plethora of offerings

Que Processing Pvt. Ltd. offers unlimited possibilities on one platform like World-class APIs, Dedicated developer portal Integrated with a modern core banking platform that provides an instantly accessible private sandbox environment that enables you to have the control in your hands.

What differs Que Processing Pvt. Ltd. from others is they deliver financial services at the point of customer need, help banks reach new customers through their partners enabling brands to serve more to their customers’ needs, and also help these brands offer new finance capabilities better and faster than they could alone.

They are the program manager who caters end to end needs of the issuance industry. Que Processing Pvt. Ltd. aims at providing Flexibility to design the program you want, build card programs, and run test transactions, enables you to launch as quickly as you can develop without dependencies on Que Processing Pvt. Ltd. provides you a platform where you can manage your own rules based authorizations with real-time data insights that don’t just let you grow but also innovate and continue to roll out new features with ease.

Mr. Vinay Kalantri – A leader with a futuristic vision

Mr. Vinay Kalantri is the founder & CEO of Que Processing Private Limited, a Mumbai-based Fintech Start-up. He is a well-known second-generation industrialist and technocrat and he was listed as 50 Most Promising Entrepreneurs of 2017. Vinay is a Fintech and payment leader with over a decade year of experience. He has been a young entrepreneur for the last 20 years.

At the age of 19, he wrote the book ‘C# Classes’ which got him appreciation from Bill Gates. His other interest includes in telecommunication, infra projects, and port associated operations

Being an entrepreneur himself, he realized the importance of credit and issues with cash flows. That’s when he found his vision to provide a cutting edge secure payment solution with real-time customer and data insights that enables innovation and helps businesses adapt, scale, and optimize. Vinay’s entrepreneurial spirit was driving him towards creating something unique, something new that would work towards making people’s lives easier.

His previous experiences include VP Sales at Reid & Taylor, Director at Any-User India, and as a Managing Director at Que Mobile, and he had worked with Balaji Infra projects Limited for 8 years as a President – Projects. He also made it to the list of ‘Top 50 Most influential payment professionals in India’ published by the world payment congress. At the age of 21, He had his first successful startup, in partnership with the Korean company named AnyUser that started the virtual IP business in India and rose to be the number one company within 9 months of its launch.

According to Vinay, the challenge of covid-19 came as an opportunity for India and China as the market of growth. We believe that today is the time to grow. We are still in the foundation stage but the recent statistics are promising as have collaborated with more than a dozen clients in the past 6 months.

He strongly believes that the MSME sector is one of the largest contributors to the Indian economy. It is significant to provide solutions in managing working capital and improving productivity by digitizing payments for them. Fintech as the sector has always supported the BFSI segment to seamlessly digitize their business spends. Having control over cash flows is what any entrepreneur would dream of and he has always worked towards that dream.

Virtual & Physical cards built on Que Processing Services modern card issuing platform offer instantaneous disbursement with spend controls and security like never before. Its unique state-of-the-art technology allows Just-in-Time (JIT) Funding virtual and physical cards to carry zero balance until disbursement.

Businesses can control the exact time, location, and purpose of each disbursement, as well as the exact amount to be disbursed at the requested time. QPS establishes itself as the pioneer of the payment industry by exclusively partnering with ‘Smart Issuance’ in India, to provide a technology that enables BFSI to instantly provision a mobile wallet empowered with a payment card, to their customers.

Words from the Founder & CEO

The upcoming changes in technology have changed the traditional way of doing business. It has digitized everything right from the time when the barter system was in the market. Now with the adaption rate to all kinds of fast innovations has brought a drastic change in the Business these days.

Long back when bank enjoyed the monopoly of doing the business and giving loans and every corporate were dependent on it. But now in these edge-cutting technology days, it’s a huge challenge to stand up in the market with the running cash flows. With customers having options to choose the best for them it’s a huge competition to sell the best. Only the one from which customers can get the best and quality of services serves.

In the Digital Age, people, places, and businesses became more interconnected than at any point in human history. As an entrepreneur, we have to understand the pain point to our customer and provide the right service to make their life easier. It is rightly said that every challenge is an opportunity. This crisis too has come with its own set of challenges and opportunities. Learnings from this will only help in developing a positive approach for Startups.

Trusted:

Dynamic controls to limit spend and reduce fraud. Data insights and fraud products for visibility and control in card programs.

Scalable:

Scalable platform with built-in redundancy, fail-over, and 99.99% up-time.

Simple:

Open APIs and developer SDKs (coming soon) to create customized cards or payment products in a matter of days.

Several countries have announced financial and social relief measures to combat the spread of the COVID-19. The Indian government has also been proactive on this front and had implemented a country-wide lockdown to control the further spread of this disease. With lockdowns imposed across the world, large digital payment platforms have flourished, and the most effective businesses are pivoting towards the Fintech sector which is witnessing a huge demand for services today.

The crisis has forced businesses to adopt digital platforms, discover new efficiencies, and adapt to a new normal of digital life by necessity. This shift in the digital demand is one of the major opportunities for all Fintech startups. They will now get to play a significant role of a mediator as a technology provider to all those who have been trying to shift from their traditional patterns and accept the digital wave.